- Summary:

- This article discusses the potential impact on the AVAX price following yesterday's sharp reversal and poor technical close.

This article discusses the potential impact on the AVAX price following yesterday’s sharp reversal and poor technical close.

Risk-off sentiment is washing across the cryptocurrency market early on Thursday as investors digest Fed chair Powell’s hawkish stance. As I write, Bitcoin is sliding lower, and now almost $3,000 below yesterdays high, triggering losses in many altcoins. Subsequently, the near-term outlook for Avalanche (AVAX) is deteriorating. The AVAX token is trading at $1115.10, around 12.5 below yesterday’s high and almost 24% the November 23rd all-time high.

In my opinion, bearish headwinds are emerging for cryptocurrencies. The obvious risk is if the FOMC bring forward the timeline for reducing asset purchases. Whilst many consider cryptocurrencies uncorrelated to equities, they have benefited from easy money. Therefore, it’s logical they will suffer if the fed turns off the taps faster than anticipated. Furthermore, despite the AVAX price reversing course recently, it’s still around 1,100% higher than in July, meaning it has further to fall than most. Of course, due to the Omicron variant, the landscape is fluid and may not result in imminent collapse. However, it’s essential to understand the potential ramifications if risk-assets suffer a prolonged bout of weakness.

Avalanche Price Analysis

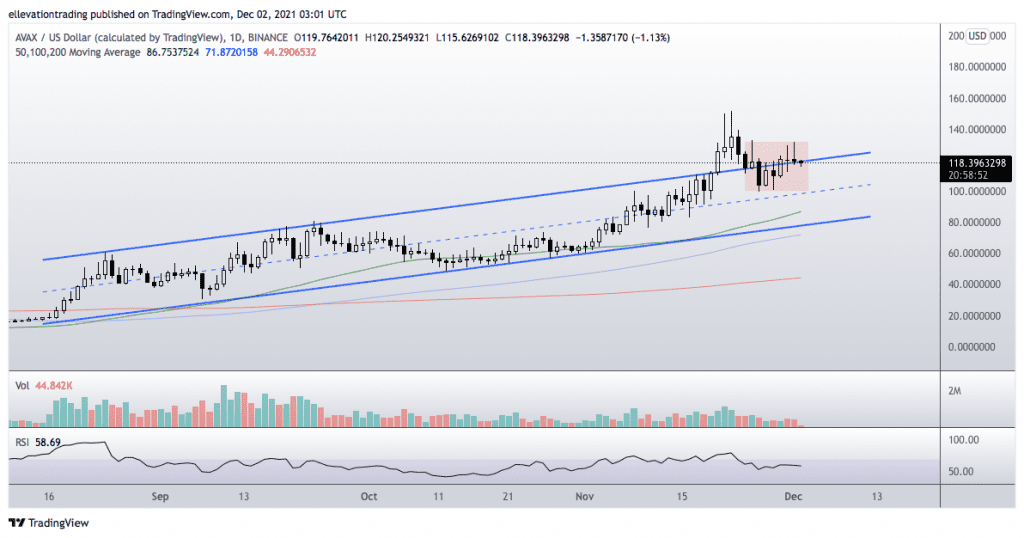

The daily chart shows the AVAX price has fallen below trend support (now resistance) at $120.20. In my view, a close below trend would constitute a failed breakout, encouraging selling.

If that happens, a logical target is the midpoint of the ascending trend channel, aligned with last weeks low at $100. In contrast, a broader sell-off would target the bottom end of the trend channel at $80, which coincidentally lines up with the former all-time high in September.

On the other hand, a close above the trend would be highly constructive, targeting the $135-$150 range. Therefore, a daily close above $120.20 invalidates the bearish view.

AVAX Price Chart (daily)

For more market insights, follow Elliott on Twitter.