- Summary:

- The Avalanche price exploded 80% in the last week, to a new all-time high, on hopes the blockchain will eat into Ethereum's market share.

The Avalanche price exploded 80% in the last week, to a new all-time high, on hopes the blockchain will eat into Ethereum’s market share. On Monday, Avalanche’s native Token AVAX reached a personal best of $151.75, lifting the layer-1 project’s market cap to over $32 billion, ranking it the 10th-largest cryptocurrency ahead of Dogecoin (DOGE).

Ethereum’s high gas fees and scalability issues have given rise to the so-called Ethereum-killers. Like Solana (SOL) and Cardano (ADA), Avalanche is a blockchain that threatens Ethereum’s position. Cardano and Solana experienced parabolic rallies to new highs in August and September before collapsing 44% and 37%, respectively. But whilst ADA failed to bounce, SOL went on to reach a new ATH earlier this month.

Now it appears it’s AVAX’s time to shine. Despite the general malaise in the market, Avalanche is one of the few blue-chip cryptos attracting considerable interest. However, the recent appreciation is similar to those of its rivals earlier this year, which could mean it’s vulnerable to a correction of a similar magnitude.

AVAX Price Analysis

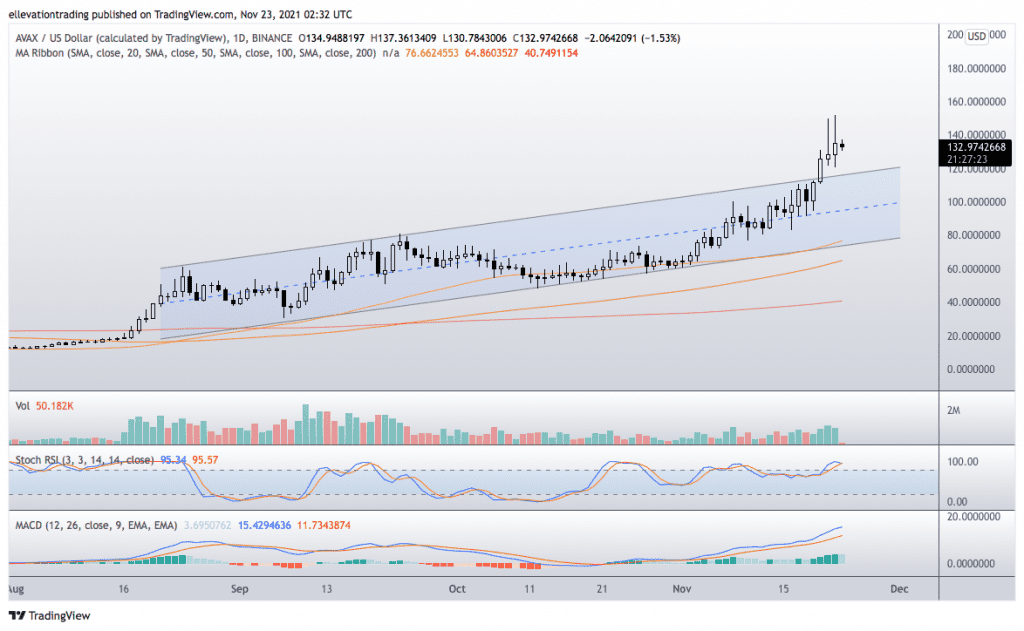

The daily chart shows the avalanche price accelerated after breaking out of a rising trend channel. The top of the parallel pattern at $113.50 is now the first support level. The impulse higher stretched to $151.75 before retracing around 12.5% to the current $133 level.

As a result of the rapid expansion, the Stochastic RSI and the MACD show signs of over-extension, suggesting the price needs a period of consolidation before moving higher. However, as long as AVAX holds trend support at $113.50, the outlook is constructive.

On the other hand, a close below $113.50 could trigger an extension towards the bottom of the trend channel at $73.00. On that basis, my current view is ‘very cautiously’ bullish above $113.50. Therefore, a close below trend support on the daily candle will invalidate the ‘very cautious’ bullish thesis.

Avalanche Price Chart (daily)

For more market insights, follow Elliott on Twitter.