- Summary:

- What is the forecast for the Avacta share price? We explain why a 45% jump is highly likely in the near term.

The Avacta share price has been in a strong comeback after it published encouraging results earlier this month. The AVCT stock is trading at 112p, which is the highest it has been since January this year. It has risen by more than 196% from its lowest level this year, bringing its market cap to about £284 million.

Avacta is a small but fast-growing company that operates in the Therapeutics and diagnostics industry. The company also has a small division dealing with animal health. Early this month, the firm said its total revenue was £2.9 4 million, up from the previous year’s £2.14 million. However, its operating loss jumped to £29 million while its loss per share rose to 10.57p.

The Avacta stock price has also risen after it unveiled a partnership with Biocytogen, a Chinese company that focuses on biological drugs. The partnership will also include the Korean Non-Clinical Technology Solution Center. According to the statement, this collaboration will lead to the development of new in vivo models and testing of AffyXell’s drugs candidates.

The Avacta share price also rose after the firm announced that its Therapeutics business had transitioned to being a clinical-stage business through the dosing of the first patient in the phase one study of AVA6000.

Avacta share price forecast

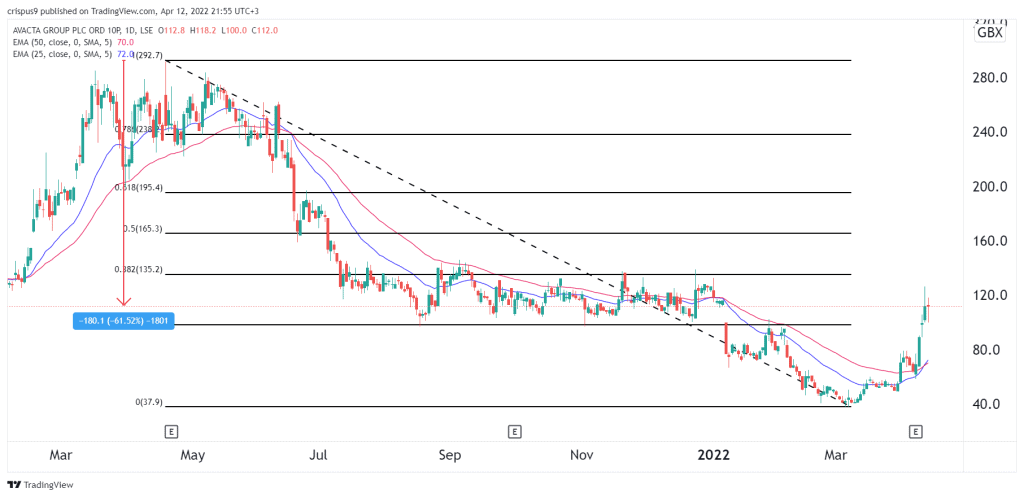

The daily chart shows that the AVCT share price has been in a strong bullish trend in the past few days. Still, the stock remains at 62% below its all-time high of 292p. However, it has moved above the 23.6% Fibonacci retracement level, while the 25-day and 50-day moving averages have made a bullish crossover pattern.

Therefore, there is a likelihood that the shares will keep the bullish momentum going on as investors target the 50% Fibonacci retracement level at 165p, which is 46% above the current level. A drop below the key support at 100p will invalidate the bullish view. It will signal that there are still more sellers left in the market.