- Summary:

- AUDUSD trades 0.37 percent lower at 0.6978 after Australian CBA - Markit Purchasing Managers’ Index for July showed that the Manufacturing PMI

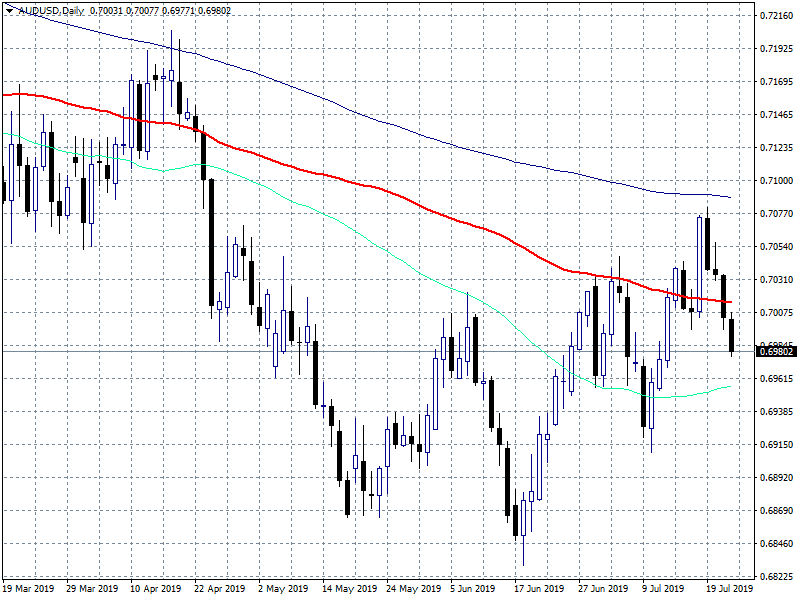

AUDUSD trades 0.37 percent lower at 0.6978 after Australian CBA – Markit Purchasing Managers’ Index for July showed that the Manufacturing PMI lagged behind 52.0 prior to 51.4 and the Services PMI also trailing the 52.6 earlier with 51.9 reading, resulting into 51.8 Composite PMI versus 52.5 previous readouts. The Aussie Skilled vacancies fell 6.7% year-on-year for the month of June.

AUDUSD continues south for fourth consecutive day after a failed break above 0.7080 the previous week. Fundamental data do not support a move higher as the recent Aussie data disappoints.

On the downside first support now stands at 0.6956 the 50 day moving average, a level that if breached will signal the closing of long positions that started to follow the recent uptrend and some traders may enter short positions targeting the 0.6909 low from July 10th. A wait and see stance on the pair looks like the best strategy for now. On the upside immediate resistance stands at 0.7007 the daily high while more offers will emerge at 0.7015 the 100 day moving average. The short term momentum for AUDUSD is clearly bearish for now and a move to lower levels looks possible.Don’t miss a beat! Follow us on Twitter.