- Summary:

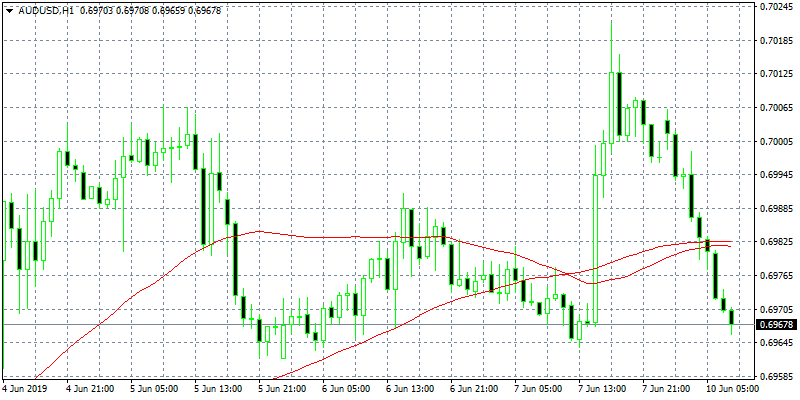

- The Aussie failed to capitalize the USD weakness the previous week. As of writing, the pair trades at 0.6966 at the daily low.

Aussie started the week weak giving up 0.47 percent to 0.6967, despite better than expected data from China’s exports. The China’s exports rose 7.7% year-on-year, beating the expected rise of 4.7% by. Imports, fell 2.5%, missing the expected increase of 5.8% and down significantly from the 10.3% rise registered in April. On the other hand Aussie fundamental data continue to disappoint investors. The Australia’s construction activity has seen its sharpest fall over six years in May. The total value of home loans fell in April by 1% with the result weighed by a 2.2% decline in the value of investor loans. Owner- occupied loan values lifted more than expected, up 1%. Aussie quarterly GDP growth picked up a little in first quarter to 0.4% q/q, although annual growth continued to slow and is now down to 1.8%, the slowest pace since 2009 in the midst of the global financial crisis.

The Aussie failed to capitalize the USD weakness the previous week. As of writing, the pair trades at 0.6966 at the daily low. The pair breached the 50 and 100 hour moving averages support zone in early Asian session and shorts took the upper hand for today. On the downside immediate support stands at 0.6960 the low from June 5th, while more bids will emerge at 0.6860 YTD low. On the upside immediate resistance now stands at the previous support at 0.6976 while key resistance stands at 0.7017 where the 50 day moving average crosses. The pair looks vulnerable below the 0.70 mark and an attempt to yearly low looks possible.