- Summary:

- The Aussie dollar trades flat during the Asian trading session at 0.6872, ahead of Wednesday’s FOMC policy update. USD got a lift on Friday after

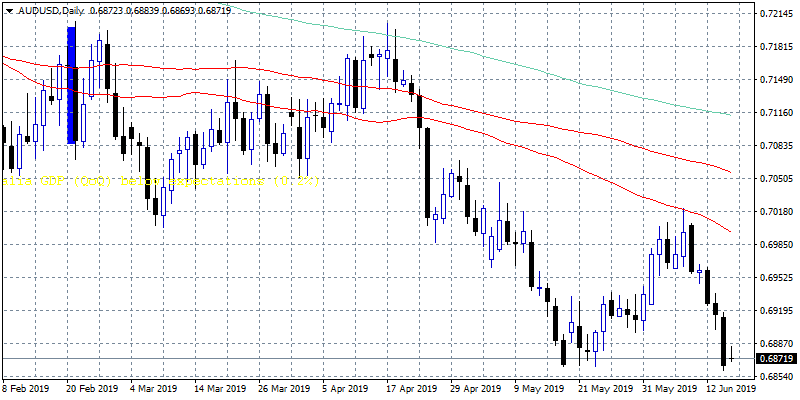

The Aussie dollar trades flat during the Asian trading session at 0.6872, ahead of Wednesday’s FOMC policy update. USD got a lift on Friday after better retail sales and industrial production. On the other hand AUD failed to capitalize on better Chiana macro figures and stronger commodities prices. Economist’s boosted bets of an RBA rate cut in July, and the yield on the Australian bond yield fell to a record low of 0.992% early Thursday after the higher than expected jobless rate.

Australian dollar had to fight the USD strength the previous week and broke below the 0.69 mark. Bears are in control and an attempt to 0.6730 the yearly low looks possible if AUDUSD breaks below the 0.6860 zone. On the upside immediate resistance now stands at the previous support at 0.6893 at the 50 hour moving average while key resistance stands at 0.6994 where the 50 day moving average crosses. The pair looks vulnerable below the 0.70 mark and an attempt to yearly low looks possible.