- Summary:

- AUDUSD trades 0.21% higher at 0.6770 breaking the 14 straight negative trading helped by better China trade data. AUDUSD was under heavy selling pressure

AUDUSD trades 0.21% higher at 0.6770 breaking the 14 straight negative trading helped by better China trade data. AUDUSD was under heavy selling pressure after neighbor New Zealand’s central bank yesterday, cut aggressively the OCR by 50bp to 1.00%, while the market forecasting a 25bp cut. The Reserve Bank of Australia kept interest rate unchanged yesterday at 1.00% at a record low as widely expected by markets.

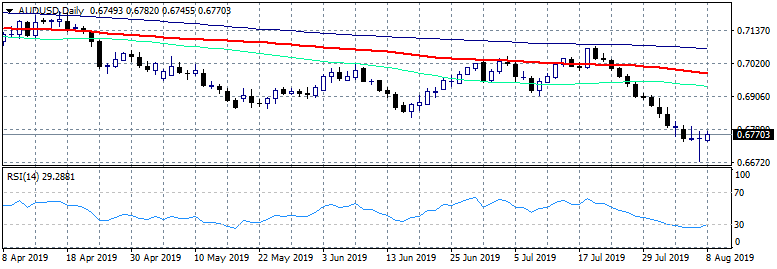

AUDUSD managed to rebound yesterday from the 10 year lows at 0.6676 above the 0.67 mark forming a hammer that suggests the pair has found a strong support at the daily low of 0.6676. Bears are in full control, on the downside first support now stands at 0.6676 yesterday’s low, a level that if breached will enhance the slide toward the 0.66 round figure. On the upside immediate resistance stands at 0.6782 today high while more offers will emerge at 0.6940 the 50 day moving average. The short term momentum for AUDUSD remains bearish for now and a move to lower levels looks possible; the pair have reached oversold levels as implied by the RSI in the daily chart which stands at 29.55, so a sharp rebound above 0.68 can’t be ruled out.