- Summary:

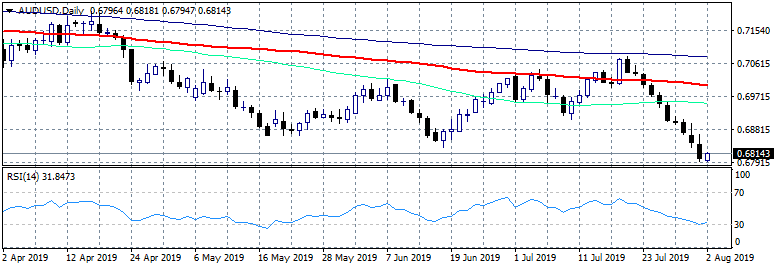

- AUDUSD trades 0.24 percent higher at 0.6814 after the pair hit fresh 7 month lows at 0.6794, after better macro data as the Australian Retail sales

AUDUSD trades 0.24 percent higher at 0.6814 after the pair hit fresh 7 month lows at 0.6794, after better macro data as the Australian Retail sales increased 0.4% in June beating expectations of 0.3% growth, and Australia Producer Price Index (year over year) came in at 2% above forecasts of 1.9% in 2Q. President Trump rattled yesterday the markets as he announced an additional 10% tariffs on the remaining USD300 billion worth of US imports from China, starting September 1st . US Federal Reserve delivered a 25bp interest rate cut as widely expected, and left the door open for more rate cuts. The previous week Governor Lowe of Reserve Bank of Australia in a speech said that it’s reasonable’ to expect lower rates for longer time and RBA is prepared to ease policy further if needed. Investors start pricing additional interest rate cuts by the Fed, as US – China trade war tensions escalate.

AUDUSD managed to rebound from the daily low at 0.6794 while already running ten consecutive negative sessions. On the downside first support now stands at 0.6794 today’s low, a level that if breached will enhance the slide toward the 0.6740 the low from December 30, 2018. On the upside immediate resistance stands at 0.6846 the 50 hour moving average while more offers will emerge at 0.6869 the 100 hour moving average. The short term momentum for AUDUSD is bearish for now and a move to lower levels looks possible; the RSI in the daily chart stands at 31.68 and is approaching oversold levels that might trigger a rebound.Don’t miss a beat! Follow us on Twitter.