AUDUSD continues lower for the third day correcting from 2-month highs after disappointment from Westpac Leading Index (month over month) which came down to -0.28% in August from previous 0.14%. Yesterday, the minutes from the recent RBA meeting kept the door open for future interest rate cuts following the two consecutive cuts in June and July this year. Analysts expect a 25 bps cut in the next meeting as the most possible scenario. As we mention in AUDUSD Retreat After RBA Minutes analysis, the committee noted that the risks to the global growth outlook were to the downside. The trade tensions between USA and China weigh on China’s growth as proved by recent macro data.

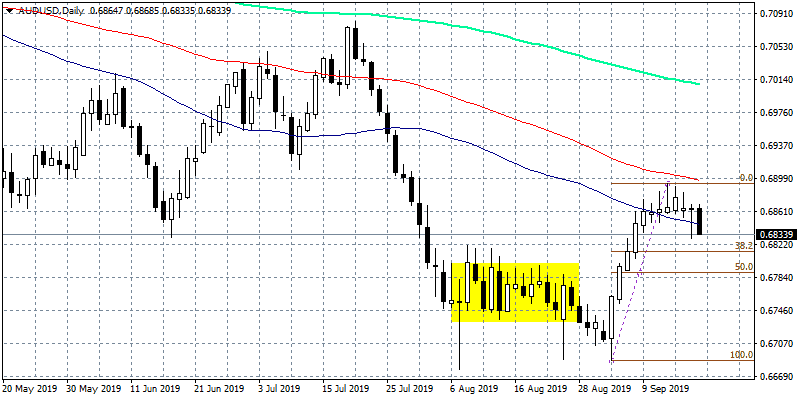

AUDUSD retreats breaking below the 50-day moving average at 0.6848. The correction it is not a surprise as the pair had an impressive run higher from 0.6687 and for nine consecutive sessions. The short term technical outlook is bearish now as the pair trades below all major daily moving averages. On the downside, first support for AUDUSD stands at 0.6834 today’s low, then at 0.6806 the low from September 6th, more bids will emerge at 0.6738 the lower band of the August consolidation area (yellow rectangular in the chart), which if breached will open the way for a visit down to 0.6688 the low from August 26th. On the upside now the 50-day moving average has turned into resistance at 0.6848 while next hurdle stands at 0.6868 the daily high.