- Summary:

- In this article, Alejandro Zambrano shares his longer-term outlook for the AUDUSD, and how tradewars and the RBA could take the AUDUSD pair to its 2009 low.

The Australian Dollar (AUDUSD) has been one of the weakest developed currencies since it reached a high against the US Dollar in early 2018. The Euro was down by about 12%, GBP by 15%, while the Australian dollar was down by 17% over the same period. The annual Australian GDP growth has dropped from early 2018 from about 3% to 1.8% in the first quarter of 2019, that is the lowest level in nine years. Westpac economists project that the GDP growth pace could drop even lower and reach 1.4% in the second quarter.

The slowdown in GDP growth is not unique to Australia and we have seen a slowdown across the world. However, China is Australia’s biggest trading partner, and they are in trouble. The Chinese economy is not anticipated to bottom out anytime soon as new US tariffs were implemented from September 1. The tradewar does not look to be resolved anytime soon, and I think the Chinese government will not back down as a bad US economy will help lower the chances of President Trump getting reelected in 2020.

As for the domestic economy, leading indicators such as the drop in Australian building approvals suggest that the unemployment rate will drop to lower levels. Australia has also suffered from low inflation and a sharp drop in house prices. The CoreLogic home value index, covering the five major cities, showed that house prices were down by 6% over the last year in September 2019.

As a result of the weak domestic and global economy, the Australian central bank, the RBA, started to reduce interest rates in June 2019. The interest rate has so far been reduced two times and at the time of writing, in early September, the rate was at 1%. Economists project that the interest rate could be lowered two more times to reach 0.5% in early 2020. There is also speculation that the RBA might introduce QE to avoid negative interest rates.

In the US, the central bank is already cutting interest rates, but the rates are still much higher than the Australian rates. At the time of writing the US key rate was between 2% to 2.25%, vs. Australia’s 1%, while the US ten-year government bond was at 1.5% and the Australian equivalent was at 0.95%.

Overall, as the situation stands right now both Australia and the US are expected to see lower economic growth, however, both interest rates and economic activity are higher in the US. Also, there is some reluctance to cut rates aggressively in the US. Finally, the Australian is more intertwined with the Chinese economy, hence, a slowdown in China should hurt Australia more than the US.

The main idea of central banks reducing interest rates is that it will support the economy by making loans cheaper, and stimulating spending. However, it takes time for lower interest rates to work themselves through the economic system. And as it stands now, economists project that the world economy could bounce back by the end of 2020. However, with trade wars ongoing it could negate the benefit of lower interest rates. What the Australian Dollar needs to stabilize is a trade deal between the US and China, or the US economy contracting sharply, and faster than Australia, until then the Australian dollar (AUDUSD) is at risk of trading lower versus the Dollar.

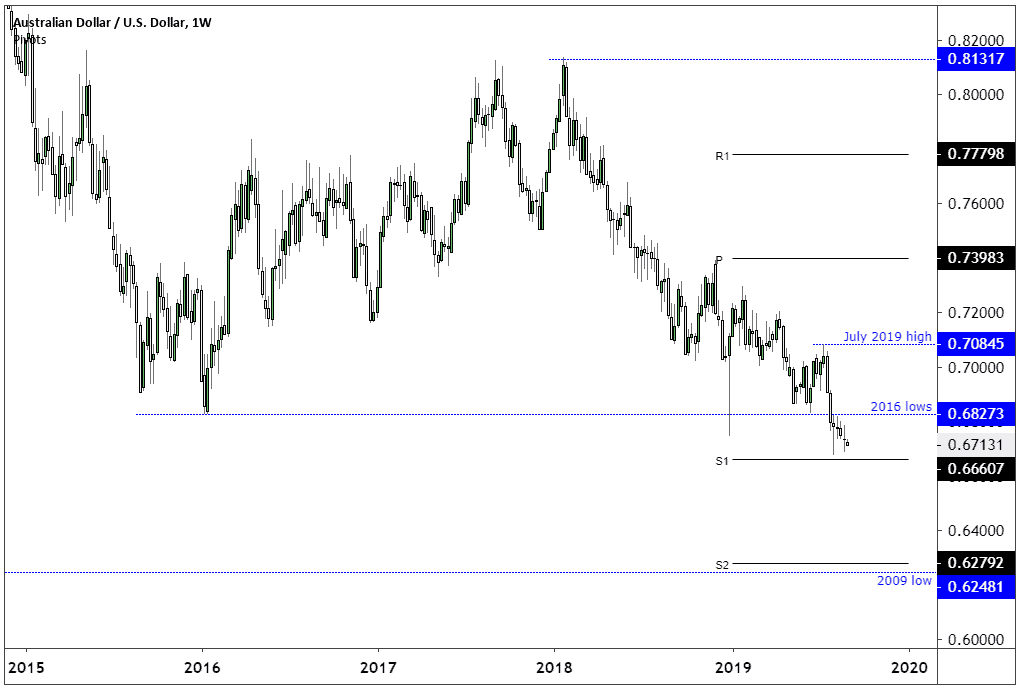

The AUDUSD pair has done a good job explaining the relative performance of the US and Australian economy, with the exchange rate drifting lower from a high of 0.8131 in January 2018 to the current rate of 0.6713. The price slid below the 2016 low of 0.6827, and this has opened the door for further declines in the months ahead. The trend will remain downwards as long as the price trades below the July 2019 high of 0.7084 and the next natural support level and potential target of traders is the 2009 low at 0.6248.

The move lower is also supported by the yearly Pivot Point indicator levels. The AUDUSD is below the yearly pivot at 0.7398 which indicates a bearish bias, and a break to the S1 level at 0.6660 should send the price to the S2 level at 0.6279.