- Summary:

- AstraZeneca share price pulled back to the lowest level since August 12 as concerns about the company’s vaccines business. What next for AZN?

AstraZeneca share price pulled back to the lowest level since August 12 as concerns about the company’s vaccines business. The AZN stock was trading at 106p on Thursday morning, which was substantially lower than August’s high of 11,534. Still, this price is about 31% above the lowest level in 2022, giving it a market cap of more than 169 billion pounds.

Is AstraZeneca a good buy?

AstraZeneca is one of the biggest pharmaceutical companies in the world. The firm does research and comes up with therapies in some of the top categories in the world. For example, it has expertise in oncology, rare diseases, respiratory and immunology, biopharmaceuticals, and other areas.

In the past few years, AstraZeneca has become popular for its Covid-19 vaccines. In 2021, the company’s Covid vaccine brought in more than $4 billion. As a result, its total revenue jumped to a record high of over $37.42 billion, which was a 42% increase from the previous year.

AstraZeneca share price has weakened recently as investors lower their expectations about the company’s revenues. In the first half of the year, the company’s revenue jumped by 48% to $22.6 billion. This growth was spread across all business segments, including the newly acquired Alexion.

Oncology revenue rose by 22% while revenue from R&I rose by 3%. CVRM and rare diseases revenue increased by 19% and 10%, respectively. As a result, its gross margin rose to 81%. Still, the biggest concern among investors is that demand for Covid-19 vaccines has dropped sharply in the past few months.

This also explains why shares of Moderna, Pfizer, and Novavax have crashed hard recently. The Covid situation also explains why the AZN share price reacted mildly to news that the firm’s Evusheld Covid-19 treatment received regulatory approval.

AstraZeneca share price forecast

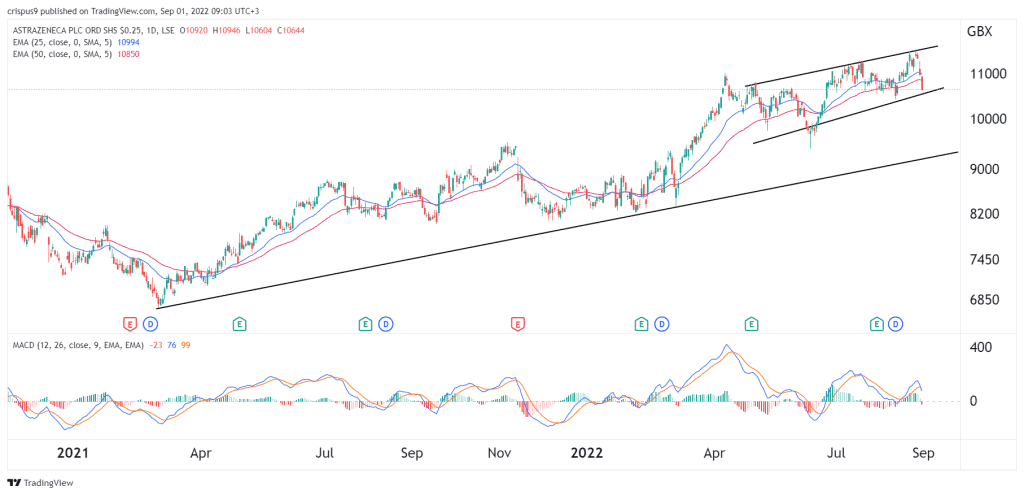

The daily chart shows that the AZN share price has been in a strong bullish trend this year, making it one of the best-performing stocks in the FTSE 100. Recently, this bullish momentum faded and the stock moved slightly below the 25-day and 50-day moving averages. The MACD has also moved slightly above the neutral point.

Also, the shares are trading slightly above the upper side of the ascending channel. Therefore, there is a likelihood that the stock will bounce back as bulls target the key upper side of the channel at 11,532p. A move below the lower side of this channel will invalidate the bullish view.