- Summary:

- Asos share price has rallied a lot in the past few months. Does the stock have more room to go in the near future?

Asos share price is up by more than 1.45% today, continuing a strong surge that started in March last year when it fell to 1,030p. Since then, Asos stock has jumped by 434%, making it one of the best-performing companies in the country. This growth has pushed its market cap to more than £5.17 billion.

The background: Asos is a large online fashion company headquartered in London. It operates its eponymous brand and other companies like Fashion Finder and Crooked Tongues. The company has been experiencing substantial growth in recent months due to the pandemic and stay-at-home orders that have increased demand for its online products.

In the most recent quarter, Asos revenue soared to more than £3.8 billion. That was a substantial increase from £1.93 billion in the same quarter in 2019. Its net income almost doubled to £142 million.

What’s happening: Today, Asos announced that it would invest £90 million in Staffordshire and create about 2,000 jobs. The company said:

“This significant investment in infrastructure and large-scale job creation is a reflection of the confidence Asos has in its future and the quality of the skills and talent available in this well-placed location.”

Therefore, Asos share price is soaring because investors are optimistic about the company’s growth. Also, investors believe that the company will release record holiday sales in the coming week. This will be in line with what companies like Sainsbury’s and Morrison have reported.

Further, Asos is said to be attempting to bid for some of the fashion retailers that went bankrupt last year.

ASC share price forecast

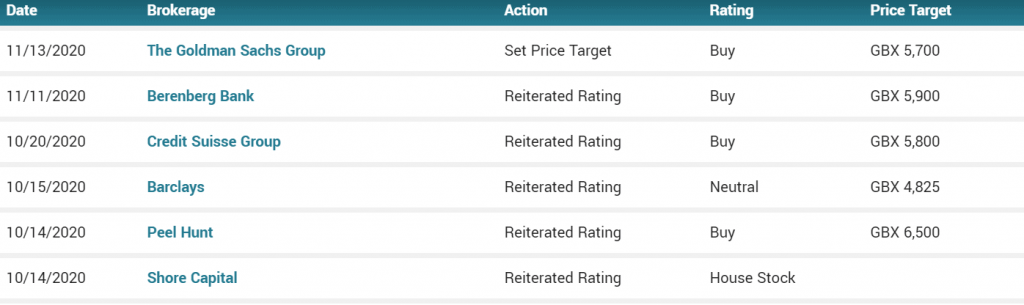

What next for Asos? Analysts are generally optimistic about ASC share price. Those at Goldman Sachs expect the stock to rise to 5,700p from the current level of 5,200p.

Similarly, those at Berenberg Bank, Credit Suisse, and Peel Hunt believe that the shares will continue rallying. The latter expects that the stock will soar to 6,500p, which is a 25% upside from the current price.

Technically, we see that Asos share price has moved above the 50-day and 25-day exponential moving prices. It is also slightly below the important resistance level at 5,546. Therefore, in the near term, we believe that the shares will continue rising as bulls aim for the next resistance at 5,600p.

Asos share price chart