Asian markets struggled for direction for one more day as traders await the restart of US – China trade negotiations. The Hang Seng trading 0.27 per cent lower at 25,552, the Singapore Straits Times index finished 0.18 per cent higher at 3,088 and the Shanghai composite ended 0,16 per cent higher at 2,928. Aussie finished lower, the ASX ended 0.10% lower at 6,573.

Nikkei 225 finished 0.02% higher at 20,625 after Japan Capital Spending came in at 1.9% for 2Q, 2019 versus previous 6.1%. Japan Monetary Base (year over year) came down to 2.8% in August from previous 3.7%. Nikkei 225 getting a boost from Unitika +3.55%, Yahoo Japan +3%, Pacific Metals +2.74%, Nomura +2.68%, and Subaru +2.42%. On the other hand Advantest -4.28%, Sumitomo Dainippon -3.59%, Fanuc -2.26%, and Hitachi Zosen -1.80%.

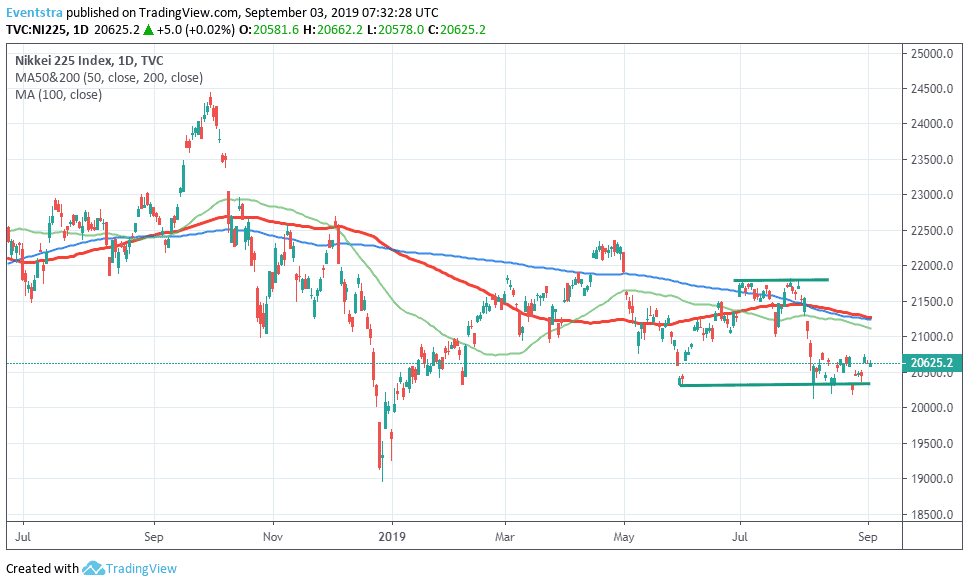

The Nikkei consolidates above seven month lows, as the index feeling safe above the strong support at 20,330 that attracts bargain hunters. On the downside immediate support stands at 20,578 today’s low and then at 20,200 the low from August 15th. A break below that level might accelerate the selloff below the 20,000 mark. On the upside resistance for the Nikkei 225 stands at 20,662 today’s high, a break above may carry more bullish implications, perhaps setting the stage for a move up to 21,114 the 200 day moving average.

In Asian forex markets USDJPY trading 0.05% lower at 106.14, the Aussie dollar trades 0,06% higher at 0.6718, while Kiwi trades 0.31% lower at 0.6288 versus USD. Gold rebounds to 1,527, while crude oil is 0.98% lower at $54.56 per barrel.