- Ashtead share price will be in the spotlight this week as the company publishes its first-quarter results. AHT stock rose to 4,337p on Friday

Ashtead share price will be in the spotlight this week as the company publishes its first-quarter results. AHT stock rose to 4,337p on Friday, which was about 33% above the lowest level this year, giving it a market cap of over 19 billion pounds. It is the only equipment rental company in the FTSE 100.

Ashtead Q1 results review

Ashtead Group is a leading British company in the equipment rental industry. The company has vast operations in the US, Canada, and the UK. In the US, the company operates the Sunbelt Rentals business which has 967 stores, making it the second-biggest firm in the industry after United Rentals. I

In the last financial year, the business brought in over 6.47 billion in revenue. Therefore, Ashtead is often seen as a bellwether for the US economy. The US division is followed by the UK, where the company has 177 stores that generated 726 million pounds in revenue. It has 89 stores in Canada, which gives it a market share of 8%.

Ashtead is a UK company whose biggest business is in the US. Therefore, it has benefited substantially from the strength of the US dollar. The dollar index surged to a multi-decade high of $109.50 on Monday morning as risks continued. Therefore, the strong US dollar will likely boost the company’s profit in US dollar terms.

However, the biggest concern for the company is that investors expect that the world economy will go to a recession as the cost of doing business rises. Historically, Ashtead usually underperforms in a period of a recession, which explains why it has fallen by over 20% this year. The company will publish its Q1 results on Tuesday.

Ashtead share price forecast

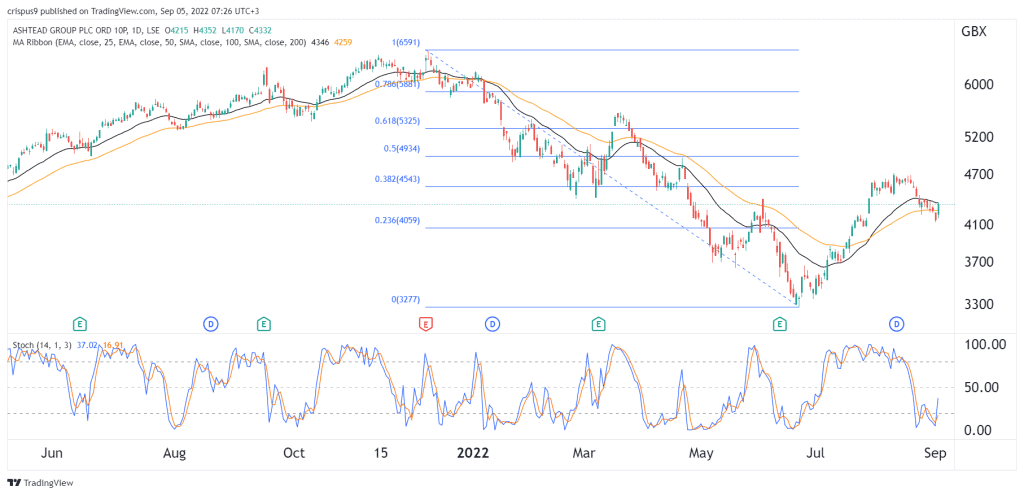

The daily chart shows that the AHT share price has been in a strong bullish trend in the past few weeks. Along the way, the stock has formed what looks like an inverted head and shoulders pattern. In price action analysis, this pattern is usually a bullish sign.

The stock has also moved slightly above the 25-day and 50-day moving averages while the Stochastic Oscillator has moved slightly above the oversold level. Therefore, the shares will likely keep rising as bulls target the next key resistance at 5,000p. A move below the support at 4,000p will invalidate the bullish view.