- Summary:

- Boohoo share price has been in a strong bearish trend and the situation keeps getting worse. The stock plummeted to a new low last week

Boohoo share price has been in a strong bearish trend and the situation keeps getting worse. The stock plummeted to a new low last week after the company warned about its outlook. It crashed to a low of 36.20p, which was its lowest level since September 2015. BOO stock has fallen by more than 905 from its all-time high.

Is Boohoo a bargain?

Boohoo has become one of the biggest fallen angels in the UK corporate scene. Once seen as a major rival to giant fashion retailers like H&M and Zara, the company has turned into a penny stock.

Along the way, the company has led to substantial losses among long-term investors. For example, the firm’s founder, Mahmud Kamani has seen the value of his shares plummet from over 570 million pounds to just 60 million. Similarly, investors who bought Boohoo shares worth £10,000 in its 2021 peak are now left with just £1,000.

The only beneficiaries of Boohoo share collapse are the many sellers who have placed bets against the company. Data shows that Boohoo is one of the most shorted stocks in the UK, with short interest surging to almost 10%.

Boohoo share price collapse continued after the company published weak results and guidance. Its sales dropped by 8% to £446 million in the three months to May. At the same time, its American franchise saw its sales drop by 28%. Another big concern for Boohoo is that its return policy was hurting its brand. Foreign exchange exposure as the pound slumps is another issue.

Boohoo share price forecast

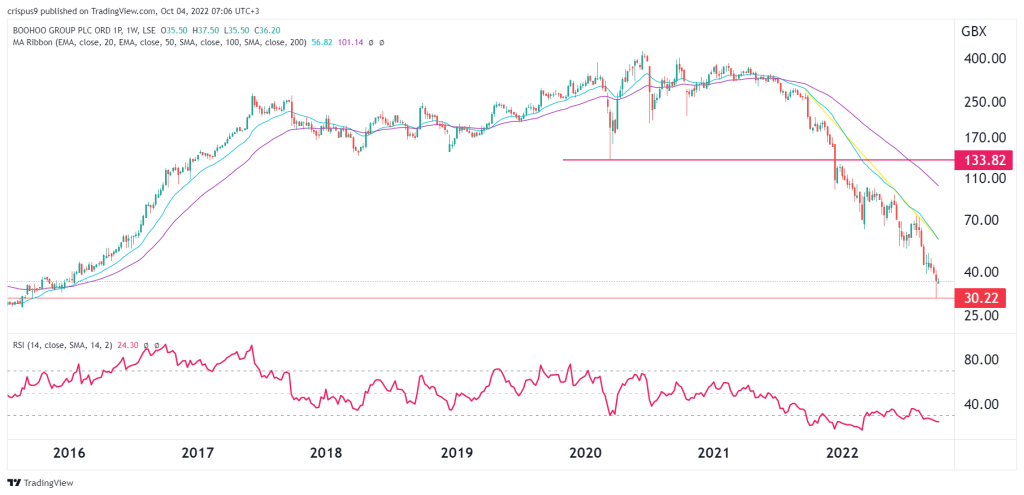

The weekly chart shows that Boohoo stock price has been in a steep downward trend in the past few months. This decline has seen it crash below the important support level at 50p. It has also fallen below all moving averages while the Relative Strength Index (RSI) has crashed below the neutral point.

Therefore, at this stage, the outlook for Boohoo shares is still bearish with the next target being at 25p. The stock will only become a good buy if it manages to move above the resistance at 50p.