- ARM Stock Price Prediction - NASDAQ: ARM is retesting its $59 support. If bulls hold this level, we may have another strong rally.

ARM (NASDAQ: ARM) stock price is heaving a breather after a great performance in its debut week. AMR IPO was launched last week, which attracted a lot of investors. However, the stock has started to show some weakness after a 4.47% drop on Friday.

On Monday, shares of the ARM Holdings turned red in the pre-market hours. At press time, the stock was changing hands at 59.58, a 1.91% drop from its last week’s close. Nevertheless, the optimism remains high due to an increasing interest from retail investors.

ARM IPO Revives The IPO Market

At a $54.5 billion valuation, ARM IPO has become a hit. Analysts are calling it the first successful IPO in months, as the IPO market has been facing strong headwinds for the past 18 months. The success of the British chipmaker’s exchange listing is being considered the green signal for the upcoming IPOs.

According to the latest reports, grocery delivery service Instacart’s IPO is also approaching. The company is targeting a valuation of around $10 billion. Due to a strong surge in ARM stock price after its NASDAQ listing, Instacart has increased its IPO price by 10%.

ARM Stock Price Forecast

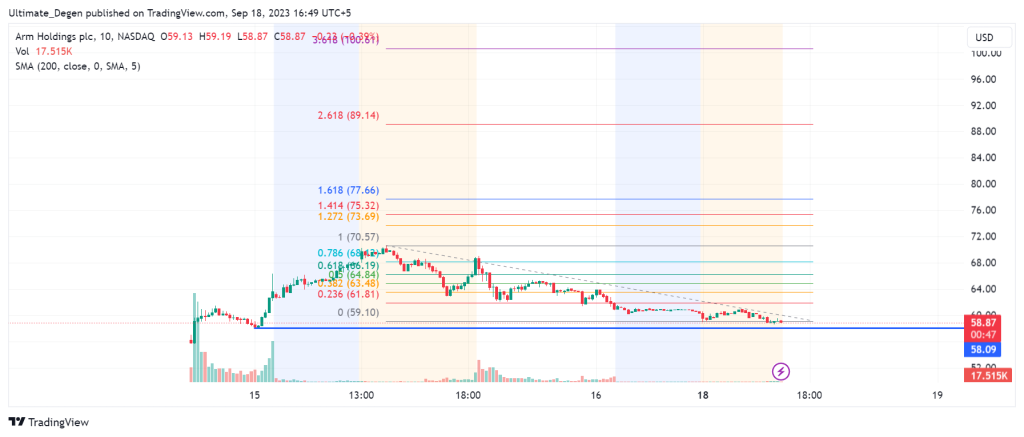

While there has been a very strong investor interest in NASDAQ: ARM, it is still too soon to predict the long-term price action. The following chart shows that there is a lot of demand around the $59 level. This demand zone must be held to aim for more upside.

In case of a strong rebound from the current level, bulls may target $77, where lies the 1.618 fib retracement level. This bullish ARM stock price prediction will be invalidated if the price breaks below $59. In that case, bears may target the IPO price of $51, which lies 18% below the current price.

You are also welcome to follow me on Twitter, where I’ll keep sharing my updated outlook on the ARM IPO and my personal trades on other US stocks.