- Summary:

- In yesterday’s trading session, the GameStop stock price closed the markets down by 4 per cent conitnuing a long-term bearish trend

In yesterday’s trading session, the GameStop stock price closed the markets down by 4 per cent. The bearish trend was a continuation of the current long-term trend that has resulted in the company losing 40 per cent of its value in the past three weeks.

However, despite the drop in the past three weeks, the company has already indicated it is working on becoming profitable again. Latest reports indicate they are planning on giving pay raises and awarding their staff with stock. According to the Wall Street Journal, store leaders will be given up to $21,00 in company stocks, which will be distributed in three annual instalments. The report also gained a memo from CEO Matt Furlong, who highlighted to his staff that the company would be focusing on achieving profitability, launching proprietary products and leveraging GameStop’s brand in new ways. Investing in GameStop stores was also highlighted and included plans to improve e-commerce and digital asset offering business models as part of the strategy.

Despite all these plans, investors are still split into buying into the CEO’s visionary goals, as described in the memo. The latest Ryan Cohen RC Ventures’ Bed Bath & Beyond (BBBY) debacle has resulted in many casting doubts about the long-term prospects of Gamestop stocks.

GameStop Stock Price Analysis

Yesterday’s fall in the markets was a reminder that GameStock stock was still under pressure, following weeks of hiccups and missteps by the company that included Ryan Cohen selling his Bed Bath & Beyond (BBBY) and putting GameStop investors on high alert.

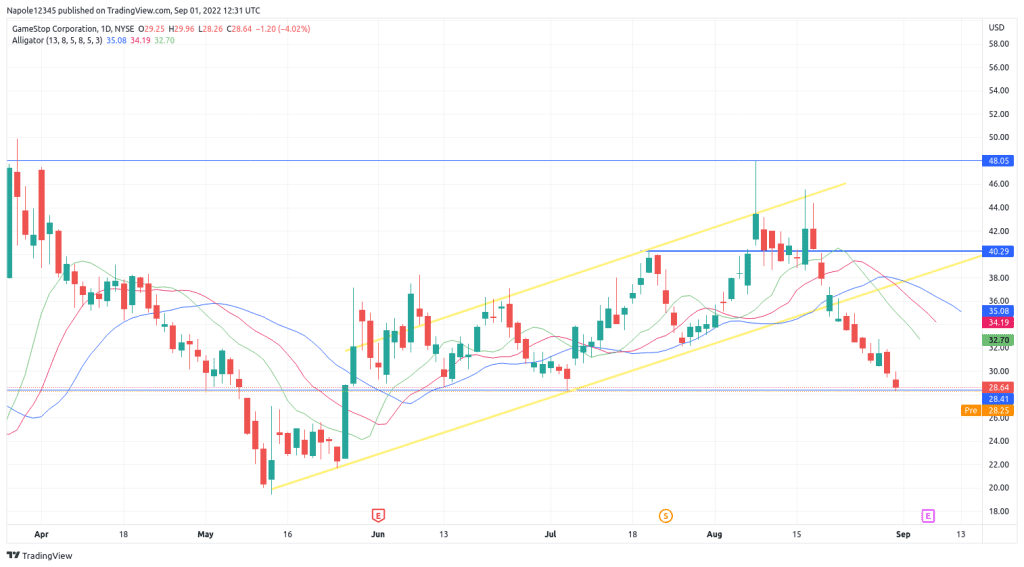

Therefore, it is not surprising that we have seen the company’s stock dropping by over 40 per cent in the past three weeks. In fact, my Gamestop Stock price prediction expects the current bearish trend to continue. There is a high likelihood that we may see Gamestop trading below the $20 price level before the end of this month. Both my short-term and long-term price expectation for the company is to the downside.

GameStop Daily Chart