- Apple stock has been a lucrative buy in the last decade. AAPL price initially declined in 2024, but has recovered on news of a major buyback.

One of the most lucrative investments of the past decade has been Apple stock (NASDAQ: AAPL). The company’s portfolio includes some of the most innovative tech products, including the iPhone, iPad, Mac Book, and Apple Watch. The company has sold its products to hundreds of millions of users and has become the most valuable company in the world.

Apple became the first company in the world as its market capitalization hit $3 trillion in July 2023-exceeding the UK’s GDP at some point. However, that valuation has declined to $2.92 trillion as of this writing. Furthermore, the company ceded the number one most valuable company position to Microsoft in January 2024, and could lose the second spot to NVIDIA, which is valued at $2.67 trillion as of this writing-and rising fast.

AAPL stock ran into headwinds in 2024, hitting a six-month low of $164 on April 19. Between January and April 2024, the stock lost 12 percent of its value, with March losses being the largest, at 5.1 percent. However, the AAPL stock decline was snapped on April 22, 10 days after the company’s quarterly earnings were released. Also, the stock rose by more than 8 percent in the first 24 hours of its first quarter 2024 earnings release.

As of this writing, Apple’s stock price has returned to its highest level since early February and currently trades at $190.15. AAPL rose by 11.6 percent in May, the highest monthly gain since March 2023. However, it is still about 1.7 percent below the YTD high of $196.38 set in January. That said, May is the first month the stock has ended with gains since the beginning of 2024. One of Apple’s existential challenges is in the AI front where it trails key competitors. NVIDIA, in particular, has been setting the pace in the US equities market and largely dictating the tech industry sentiment in 2024.

This article was initially published on May 31st, 2024, and is frequently updated to reflect the latest Apple price action and technical analysis.

What is Apple stock?

Apple is the biggest corporation in terms of market cap. Its stock is listed on the NASDAQ stock exchange in the United States. The ticker symbol of Apple stock is AAPL. As of this writing, the price of AAPL is $190.15, which is around the same level it opened the year at on January 2.

Apple Latest news

Berkshire Hathaway sold 116 million AAPL shares worth about $21 billion in the first quarter of 2024, as per fillings. The Apple stock had for a long time constituted about 50 percent of the Warren Buffet-led investment juggernaut, but currently constitutes about 40 percent. While this might trigger negative sentiment among some investors, it is worth noting that Berkshire took the decision to leverage the historically low corporate taxes of 21 per cent.

On May 16, Apple CEO Tim Cook announced on X that the company would launch a suite of accessibility features that will enable customers to operate their iPads and iPhones using only their eyes. One of the key functionalities is eye tracking, which employs artificial intelligence to enable people with physical disability to use iOS and iPadOS. Later this year, iOS and iPadOS 18 will have these capabilities integrated.

The excitement about these new features is not so much about Apple’s focus on accessibility for all as about the fact that the company is signaling strength in AI. Until now, Apple has trailed competitors in AI advancements, a factor that dampened optimism about its medium—and long-term growth prospects.

That said, if recent news reports are anything to go by, Apple seems to have ceded some ground in the AI race. Bloomberg reported in May that the iPhone maker was negotiating with ChatGPT to integrate some of its features into its handsets. In addition, it has also been reported that the company is in talks with Google to integrate the Gemini AI engine into its phones.

During the release of its first quarter 2024 earnings report, Apple announced that it would buy back $110 billion worth of stock. This historic buyback underlines the company’s strong financial muscle and will certainly boost the stock price in the coming weeks.

One of the concerns bubbling under the AAPL stock price is the decline in sales in China. Apple’s sales in Greater China declined from $17.8 billion to $16.4 billion in the first quarter of 2024, underlining this reality. However, the performance exceeded analysts’ expectations, which had forecast sales of $15.3 billion.

In other news, CEO Tim Cook, COO Jeff Williams, CFO Luca Maestri, senior vice president of retail Deirdre O’Brien, and General counsel Katherine Adams sold $70 million worth of their APPL stock holdings in April.

Apple chart

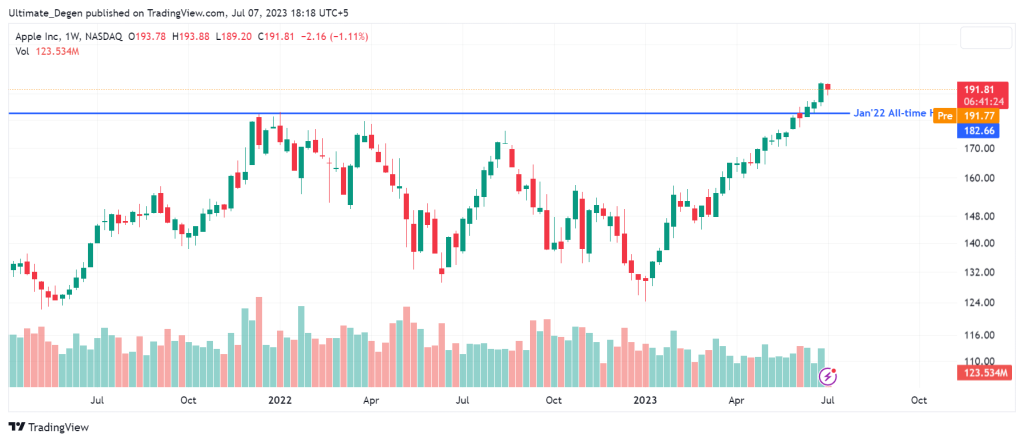

The following NASDAQ: AAPL weekly chart shows that the stock had almost a 30% pullback in 2022. The stock hit its bottom on the first trading session of 2023 and has been in an unstoppable uptrend since then. In December 2023, the Apple share price surged to a new all-time high of $199.62. Therefore, despite the lull in 2024, the stock has proven its ability to make strong recoveries and erase losses.

Apple stock forecast today

The momentum on AAPL stock price signals that the sellers are in control. Furthermore, the downside will likely continue to prevail if they keep the price below the 190.49 pivot mark. That could establish the first support at 189.78. A continuation of that control will likely break the first support and potentially move the stock lower to test 189.08. Conversely, a move below 190.49 will favour the sellers to breach the resistance at 191.39, which would invalidate the downside narrative. Also, such a move could enable them to build momentum to test the psychological resistance level of 192.17 in extension.

Apple Stock 2024 Roundup

Apple (NASDAQ: AAPL) had a mixed year in 2024, marked by strong product momentum but weighed down by macro headwinds and regulatory heat. After a shaky first quarter tied to supply chain concerns and weaker iPhone sales in China, Apple bounced back mid-year with record revenue from its services segment and growing excitement around AI-powered features in iOS 18.

The stock hit fresh highs in June following a broader tech rally, but momentum cooled in Q3 amid antitrust scrutiny and slowing hardware demand globally. Despite the noise, Apple remained a cash machine, with consistent buybacks, healthy margins, and strong brand loyalty.

By year-end, AAPL had gained modestly, underperforming some mega-cap peers like Nvidia but still holding its ground in a volatile tech landscape. Investors are now watching closely to see how Apple’s AI roadmap and next-gen hardware, including the Vision Pro, will shape sentiment in 2025.

Apple Share Price Prediction: AAPL Holds 211 as Tech Sentiment Stabilises in April 2025

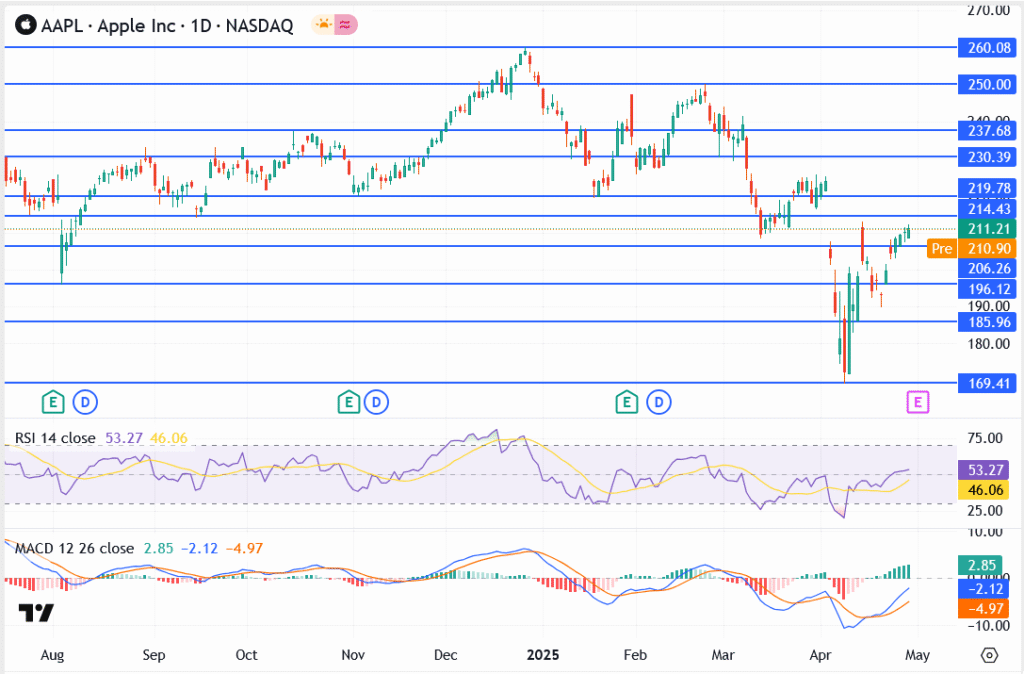

Apple Inc. (NASDAQ: AAPL) is attempting a rebound after a rough start to the year, with its share price trading around $211.21 today. The stock has gained over 13% this month alone, recovering from early April’s sharp dip below the $190 level. After reaching all-time highs of $258 in late 2024, AAPL struggled through Q1 but is now showing signs of life as broader tech sentiment begins to recover.

The recent move higher has been supported by improving risk appetite, easing Treasury yields, and renewed bets on AI-related growth across megacap tech. For Apple, the near-term story is still about stabilisation, but the chart is beginning to tell a more constructive story heading into May.

AAPL Technical Analysis: Can Bulls Break 214?

The share price is currently holding above $210.90 — a key pivot zone. If momentum continues, the next resistance level to watch is $214.43, followed by a deeper challenge at $219.78. Above that, $230.39 is the next major barrier.

Support now sits at $206.26, and below that, watch for reaction near $196.12. If sentiment sours again, downside risks open toward $185.96.

- Resistance levels: $214.43, $219.78, $230.39

- Support levels: $206.26, $196.12, $185.96

- RSI: 53.27 — slightly bullish, nearing neutral zone

- MACD: Just flipped positive, momentum building cautiously

The price structure suggests consolidation just below resistance, with early signs of upward bias, but bulls still need to prove control.

What’s Moving Apple Stock in 2025?

- AI Growth Narrative: Apple is catching up in the AI race, with growing expectations around new Siri upgrades and chipset developments.

- iPhone 17 Rumors: Anticipation is already building for Apple’s fall product cycle, which may include new AI-driven features.

- Buyback Programs: Speculation is swirling about another round of aggressive share repurchases, possibly announced during its upcoming earnings call.

- Services Revenue: Steady App Store growth and stronger-than-expected iCloud and Apple TV+ numbers have been keeping margins intact.

Investors are also watching macro indicators any signal from the Fed on rate cuts or a softer labor print could offer additional upside for big tech.

AAPL April Recap: Recovery in Motion, but Not Out of the Woods

April has been a recovery month for Apple. After a dramatic plunge to the $169 area on April 3, AAPL has clawed back more than 20% from its lows. The rally has been fueled by improving sentiment across tech and early optimism around Q2 earnings due next week.

Still, Apple hasn’t reclaimed its pre-earnings breakdown zone at $219. Traders will need to see a firm break above $214 to signal continuation. If that happens, the stock could easily revisit the $230–$237 range from February highs.

So far, 2025 has been a mixed bag, but April closed with strength. Whether Apple can turn that into a sustained run will depend heavily on its earnings and guidance next week.

I’ll keep updating my AAPL price forecast in my free Telegram group, which you’re welcome to join.

Apple stock forecast 2030

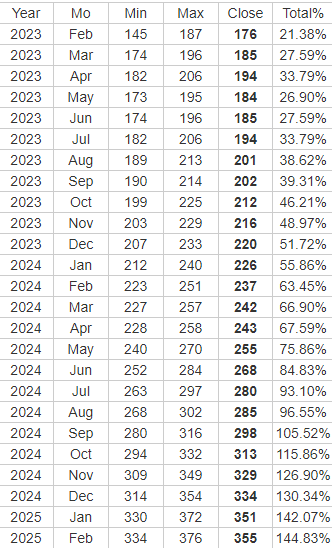

If Apple keeps delivering the most innovative products, then its stock price should see an organic increase till 2030. This is if the demand for flagship Apple products also increases considerably in the next few years. If the Fed starts to decrease interest rates in 2024, then Apple can reach a new all-time high by 2025. By 2030, the Apple share price prediction can be as high as $600.

Apple stock forecast 2040

Stock price of any company 10 years from now is anybody’s guess. Nevertheless, we can still use the price history to take a shot at Apple stock forecast 2040. Considering the exponential run of Apple price in the past decade, $1000 per share seems to be a quite conservative price target.

Is Apple a good investment?

Apple had a scintillating run in 2023, setting a record high stock price in December. However, 2024 has turned out to be a different ball game, with AI grabbing the headlines. Apple’s Vision Pro VR headset has not captivated the market as imagined, not less because of its steep price tag. Also, the AI revolution has gathered far much greater pace than the metaverse dream, and Apple might have to restrategise.

Having said that, if there’s one company that has proven its ability to innovate and come up with captivating, cutting-edge product, its Apple. The company may have fallen behind in AI, but you can bet that it will conjure up something that will almost certainly capture the world’s attention.

How to buy Apple stock?

As mentioned earlier, Apple stock is listed on US Exchange Nasdaq, which is the second largest stock exchange in the world. Apart from Nasdaq, you can also invest in AAPL by online retail brokers like Exness, eToro, Robinhood, Fidelity, etc. Personally, I trade on Exness where the signup is free from any hassle.

Should I buy Apple stock?

Investing in equities is one of the riskiest financial practices. Therefore one must assess their own risk appetite before investing in stocks. Nevertheless, considering the past returns of the US equities and tech stocks, it seems quite logical to maintain some Apple exposure in your long-term portfolio.

When did Apple stock split?

A stock split is simply an increase in the number of shares of a company while its market cap remains the same. As the name suggests, each share splits into multiple depending on the splitting factor. The last Apple stock split occurred in 2020. The reasons of this action include managing stock-based compensation for Apple employees and share repurchase programs.

How many times has Apple stock split?

In all of its price history, Apple stock has split a total of 5 times. These splits occurred on June 16 1987, June 21 2000, February 28, 2005, June 9 2014 and August 28, 2020. It has been observed that investor interest in stock increased every time after the announcement of a stock split.

Why is Apple stock so cheap?

When compared to the price of many Fortune 500 stocks, Apple stock price appears to be low. It must be noted here that the number of outstanding shares of every company is different. Therefore a market cap of a company is a better depiction of its worth than its stock price.