- Summary:

- The US Trade Representative has announced a delay on 10% tariffs on electronic components sourced from China until December 15th, boosting Apple's shares.

Shares of Apple spiked Tuesday after the US Trade Representative (USTR) Lighthizer announced a delay in additional tariffs on some Chinese imports such as components of cell phones, electronics, laptops, clothing and footwear until December 15. These tariffs were to take effect on September 1 and would have affected components used in making iPhones, iPads and Macs.

According to the report from Reuters on this issue, the USTR was quoted as saying: “some products are being removed from China tariff list based on health, safety, national security and other factors; will not face additional tariffs of 10%.”

“Other products for which tariffs are delayed are video game consoles, certain toys, computer monitors, and certain items of footwear and clothing.”

“Will publish on its website today and in the federal register as soon as possible more details, lists of the tariff lines affected.”

Shares of Apple spiked by as much as 5% on the news as concerns over the additional cost of production and the expected negative effect on Christmas sales have eased. Apple is scheduled to release a new version of its iconic iPhone in September.

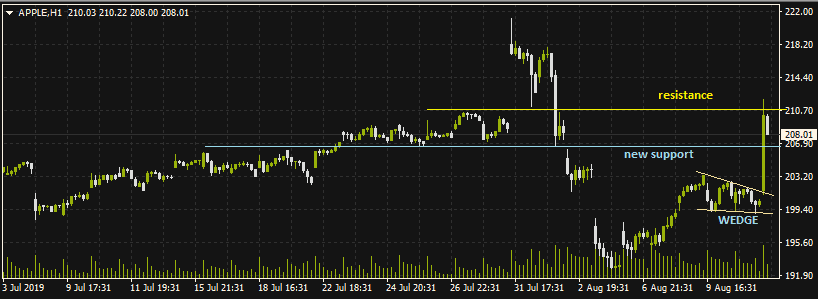

Technical Play on Apple

The stock was lodged in a falling wedge consolidation pattern, after having recovered some ground that was lost when President Trump announced new tariffs a few weeks ago. This latest news gave the stock the impetus needed to complete the pattern with a bullish breakout. Price hit the 210.10 resistance level and is experiencing a pullback. The new support formed by the late July lows at 206.70 may be a possible dip buying area.

If the downside pullback fails to hold at support, a retest of the 202.50 support area is possible. A bounce at 206.70 will retest the 210.10 resistance.