- The ANKR price prediction shows a high chance of a short term pump if the 0.08154 resistance mark is breached.

Two successive days of price gains on the ANKR/USDT pair have boosted the ANKR price predictions to the upside. Monday’s 13.9% gain was followed by Tuesday’s 6.33% move to the upside. Wednesday has brought with it some profit-taking, as the pair is currently trading 2.7$ lower as of writing. There has been some interest in the ANKR token after the company purchased the FantomFDN Tools Remote Procedure Call (RPC) tools to expand its decentralized public RPC support.

A public RPC support provides a more open endpoint to the blockchain and powers apps and wallets built on the Web 3.0 infrastructure. It also creates more decentralization for nodes that power the blockchain, which reduces the network’s vulnerability to attacks and hacks. ANKR hopes to use this public RPC to make its network more scalable and decentralized. ANKR’s 50+ chains currently serve more than 20,000 RPC endpoints.

ANKR has also launched an Earn program, where users can unstake their BNB tokens and earn rewards. The user can access instant liquidity in the form of aBNBb. You can buy aBNBb at a discounted price using a decentralized exchange and unstake this on ANKr Earn to get a small profit. This staking mechanism also makes the price of aBNBb more resilient when it comes to the impact of the liquidity pool size.

ANKR Price Prediction Outlook

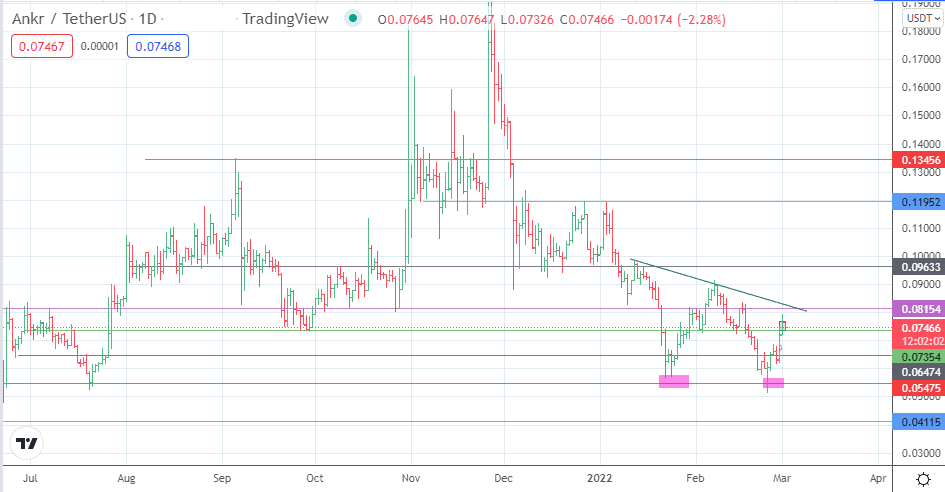

Tuesday’s break of the 0.07354 resistance has been followed by a return move to the broken resistance. This new support is expected to resist this move, and an accompanying bounce should make 0.08154 the next target in line. After that, 0.09633 becomes viable if the advance continues, with the 28 December/3 January highs at 0.11952 stepping into the picture if price appreciation continues.

On the flip side, degrading the 0.07354 former resistance-turned-support may allow for a price deterioration towards 0.05475. As a result, the 27 June 2021 low at 0.06754 may form a temporary pitstop. Only when a decline below 0.05475 occurs can 0.04115 (22 February 2021 high) become a viable target to the south.

ANKR/USDT: Daily Chart