- Summary:

- AMTD stock price has had a wild ride as a publicly-traded company. The stock surged from a low of $14 in July to an all-time high of $2,350.

AMTD stock price has had a wild ride as a publicly-traded company. The stock surged from a low of $14 in July to an all-time high of $2,350. Yes, that was a near 20,000% gain within a few days. At its peak, the company had a market cap of billions of dollars. At the time of writing, HKD stock has crashed by 97% from its all-time high, giving it a market cap of about $13 billion. This makes it more valuable than Credit Suisse and American Airlines.

Is HKD a good buy?

AMTD is a Hong Kong-based company that provides numerous financial services. For example, the company owns Airstar Bank, one of the eight virtual banks in Hong Kong. It owns the bank in collaboration with Xiaomi, the giant smartphone company. The company also owns AMTD Risk Solutions, which is an insurance brokerage provider.

In addition, the company provides digital media, content, and marketing, digital investments, and the Spider Network ecosystem. AMTD had total revenue of more than $25 billion in 2021, which makes its valuation fascinating. Indeed, at its peak, the company had a market cap of over $400 billion, making it bigger than giants like JP Morgan and Goldman Sachs.

In addition to retail traders hype, there are other reasons why the HKD share price surged. For one, its deal with Xiaomi is a big one since the company is seen as China’s Apple. Most importantly, before he sold its shares, Li Ka Shing was a big investor in the firm. Li is the second-richest person in Hong Kong.

Therefore, it is clear that AMTD stock price is severely overvalued and disconnected from reality. As such, as we have seen with other meme stocks like GameStop and AMC, the end for meme stocks is usually much lower.

AMTD stock price forecast

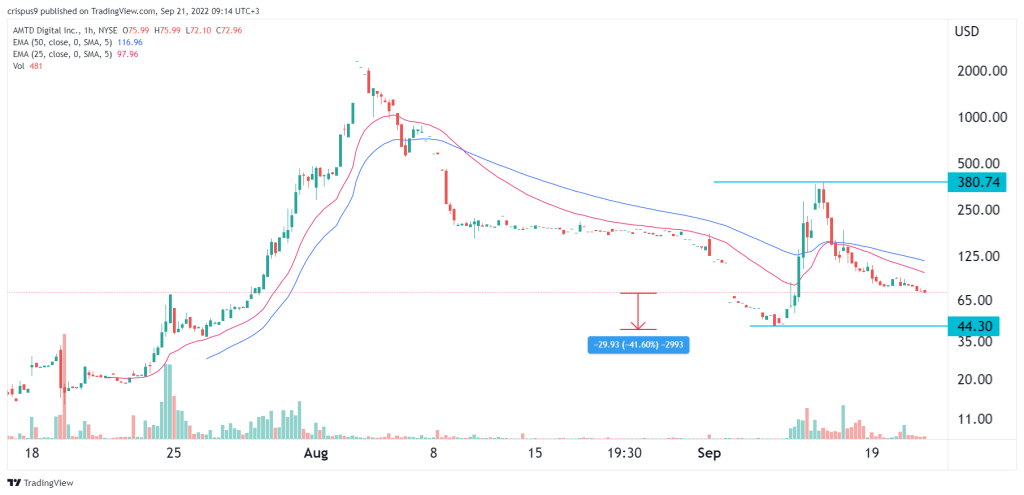

The hourly chart shows that the HKD share price has been in a strong bearish trend in the past few days. In this period, it has crashed below the important resistance level at $380. It has moved below all moving averages. A closer look at the chart shows that volume has started to dry up.

Therefore, there is a likelihood that the stonk will continue falling as sellers target the key support at $44.30, which is about 44% below the current level. A move above the resistance at $100 will invalidate the bearish view.