- Summary:

- The AMP price predictions is for a new rally-selling opportunity to develop as a lack of buying momentum hits the AMP/USDT

Any bullish AMP price predictions remain in the air as the recovery momentum that helped the token push off its recent all-time low at 0.00976 by 25% appears to have dried up. This is reflected in the low ranges being shown by the recent daily candles.

The AMP/USDT is up 0.83% this morning, following the crypto market’s general trend, which has shown some resilience this Monday. Despite the news that the number of holders of the token has remained constant, with the amount of the token staked now at all-time highs, this has not reflected in the recent AMP price predictions. The general market sentiment continues to be the prime mover of price action on the pair.

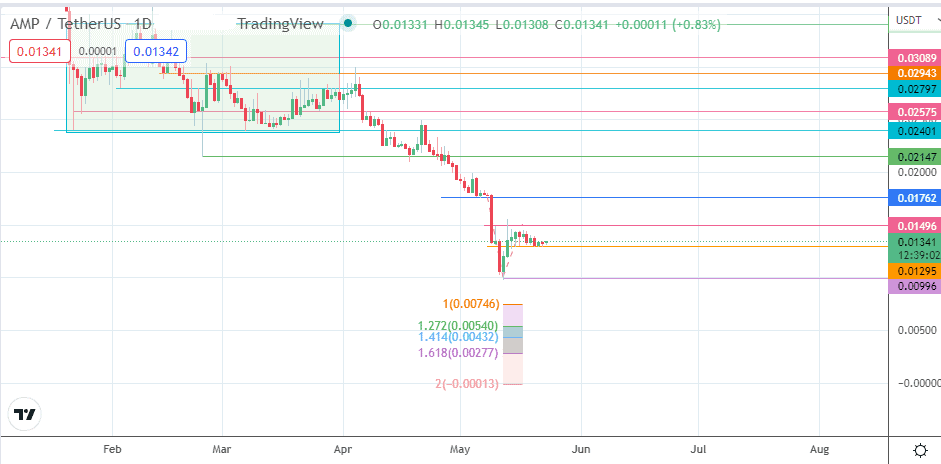

In the absence of notable fundamental triggers, the AMP price predictions in the short term will be determined by the state of the market in general and by the technical patterns on the charts. Technically speaking, the recent market decline has pushed the AMP/USDT pair to new all-time lows, from which it is struggling to break from. The recent recovery and pullback has kept the pair within the range formed by 0.01295 as the floor and 0.01496 as the ceiling. The price action would need to push of these borders to define a new trend for the asset.

AMP Price Prediction

The AMP/USDT pair has found support at the 0.01295 price mark (16 May/20 May lows). The bulls need additional momentum to propel off this support, targeting 0.01496 (10 May high) as the immediate upside mark. Above this level, additional target points to the north are seen at 0.01762 (5 May low) and 0.02147 (24 February and 24 April lows).

On the other hand, a decline below the 0.01295 support opens the door toward the 0.00996 support (12 May lows). Below this level, new lows will form, potentially at the 0.00746 and 0.00540 price levels (100% and 127.2% Fibonacci extension levels). 0.00432 (141.4% Fibonacci extension) is also another potential harvest point for the bears if extensive price deterioration occurs.

AMP/USDT: Daily Chart