- Summary:

- The AMD stock forecast from Bernstein and BofA remain bullish in the medium term despite recent pullbacks in price action.

Despite Wednesday’s steep drop in price, the AMD stock forecast for the medium term remains bullish. Following a robust bull run from June 2021 to early December of the same year, 2022 has begun with a steep correction on the stock. However, this appears not to have dampened AMD stock forecasts of institutional investors.

Recent AMD Stock Forecasts: Bernstein and Bank of America (BofA)

Analysts at the Bank of America remain bullish on AMD. According to BofA analyst Vivek Arya, the graphics chip market where AMD operates, is still in the upgrade cycle’s early stages. The second half of 2021 should produce more robust growth as supply conditions remain constrained. The analyst has a BUY rating for the AMD stock price.

Another institutional analyst at Bernstein also upgraded the firm’s outlook for the stock to “outperform”, setting a price target of $150. This allows for a potential AMD stock forecast of a rise of 32%. Bernstein analyst Stacy Ragson said that AMD’s valuation is “downright attractive”, as the company possesses increasingly bankable earning power. The analyst also noted the 30% pullback in price from its November peak despite and notes that this factor has made the AMD share price an attractive proposition, noting that the current valuation is the cheapest it has been since 2017.

This is the first BUY rating issued for AMD stock in 10 years, as the company gains more market share at the expense of its rivals at what is considered a relatively low price. AMD’s market share for central processing unit chips for laptops has climbed to 20% in Q3 2021. AMD held a market share of under 5% in this segment six years ago, showcasing the company’s strides in its recent history.

AMD Stock Forecast

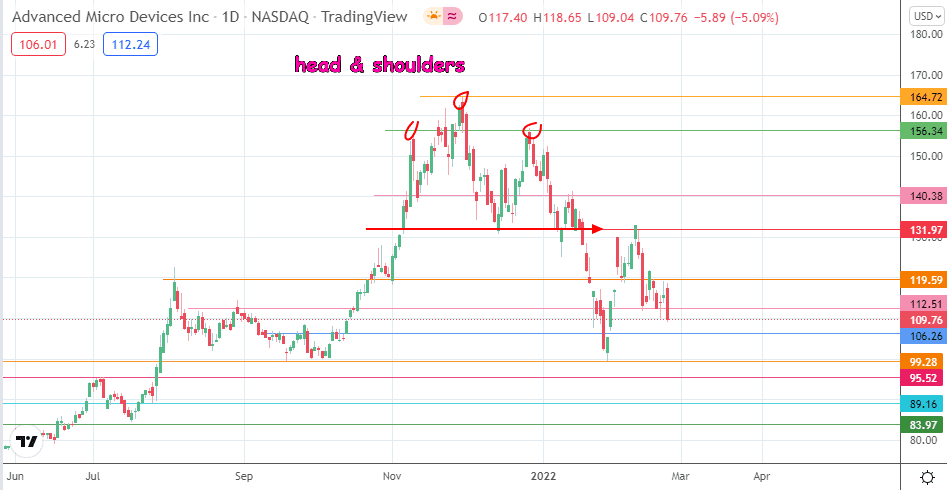

The AMD stock forecast from institutional investors may be bullish, but the short-term price action says otherwise. The decline on Wednesday followed the market’s risk-averse reaction to the Russia-Ukraine situation, with a breakdown of the 112.51 support. This breakdown opens the door for a run to the south, where 106.26 is the immediate pivot. If the price declines further, 99.28 and 95.52 enter the picture as primary targets to the south.

On the flip side, the bullish forecast by institutional investors requires a bounce from any of the support levels mentioned earlier, ultimately taking out resistance barriers at 119.59 and 131.97 to restore the bullish bias.

A run towards 140.38 follows the break of 131.97 (neckline of completed head and shoulders pattern). 156.34 and 164.72 (tops forming the head and shoulders pattern) also have to give way for AMD to record new highs in the future.

Follow Eno on Twitter.