- Summary:

- The consolidation of the stock between 11.96 and 13.32 leaves the AMC stock forecasts without a direction at the moment.

AMC stock forecasts remain guarded as the shares of AMC Entertainment ended modestly higher in Friday’s trading session. However, this mild uptick only helped to keep the price in consolidation. Ordinarily, this should not have provoked market attention.

But the comments of a hedge fund manager at AQR Capital Management, Cliff Asness, on a CNBC program in which he dared the retail trader to “try to hurt us” appear to have upped the stakes on the stock. Recall that several hedge funds lost heavily on short positions on AMC and other meme stocks when retail traders opposed their positions in January 2021.

At least two hedge funds had to close shop due to untenable losses from this action. Other events within the company appear not to be having any impact on AMC stock forecasts. A few days ago, shareholders of AMC had voted against the $19 million pay package proposed for CEO adam Aron.

However, the vote is advisory and is not binding on the company. AMC had defended the salary increases for Aron and other top executives, praising them for steering the company through the pandemic. Aron received compensation of $18.9m in 2021, 10% lower than in 2020. The AMC share price closed trading on Friday 3.49% higher.

AMC Stock Price Forecast

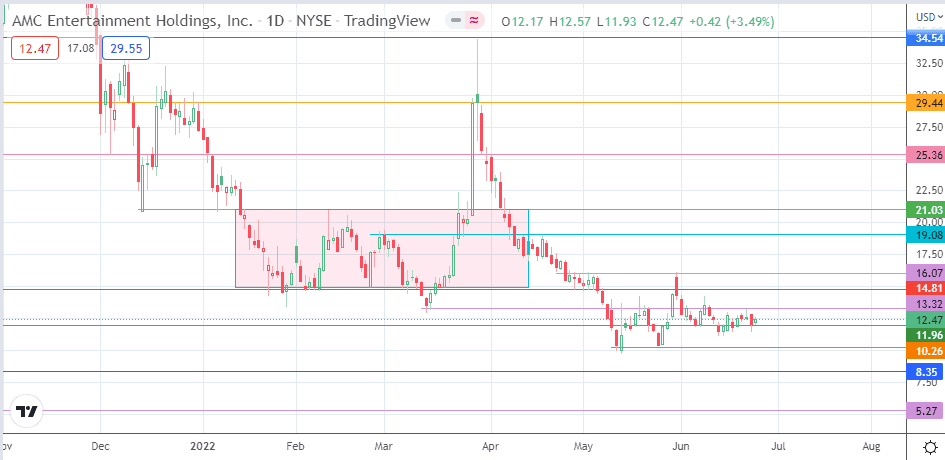

The double bottom of 12 May and 25 May resolved with a break of the neckline at 13.32 (15 March low and 18 May high), attaining completion at the 16.07 resistance, where the previous high of 9 March and 29 April were found. Following the pattern’s completion, a correction met support at the 11.96 price mark (7 June 2022).

The candle formation of note is the bullish harami. A bullish resolution of this candle requires the bulls to form an outside day candle that closes with a 3% penetration above the 13.32 resistance to clear the way toward the 14.81 resistance barrier (24 February, 21 March, and 28 April lows). Above this level, 16.07 and 19.08 (12 April high) are additional targets to the north.

On the flip side, a breakdown of the support at 11.96 opens the door toward the 10.26 support level that housed the previous double bottom. Below this level, the 8.35 (12 April 2021 low) and 5.27 (9 February 2021 low) price marks form additional pivots. The 7.50 price mark that houses the 4 March 2021 low also forms a potential pitstop.

AMC: Daily Chart