- Summary:

- The AMC stock forecast is for selling to resume after the recent rally in the stock price, as the stock remains in a downtrend.

The AMC Entertainment Holdings stock is up nearly 2% in premarket trading, which sets up the potential for a higher open and bullish AMC stock forecast. This follows the 10.16% advance on the stock on Tuesday.

The recent uptick which has boosted AMC stock forecasts comes from the disclosure of AMC’s acquisition of a 6.8% stake in National CineMedia. The world’s largest movie theatre chain disclosed this in a 13G filing late Tuesday. Shares in both stocks saw demand after the announcement, helping AMC Entertainment off the recent lows.

The uptick also follows a large bullish order in the options market for the AMC stock. As provided by six Wall Street analysts, the current 12-month price target for AMC Entertainment shows a median target of 5.00, with high and low band estimates at 16.00 and 1.00. The median price estimate indicates the potential for a drop in the AMC stock price in the medium term. What do the charts say?

AMC Stock Forecast

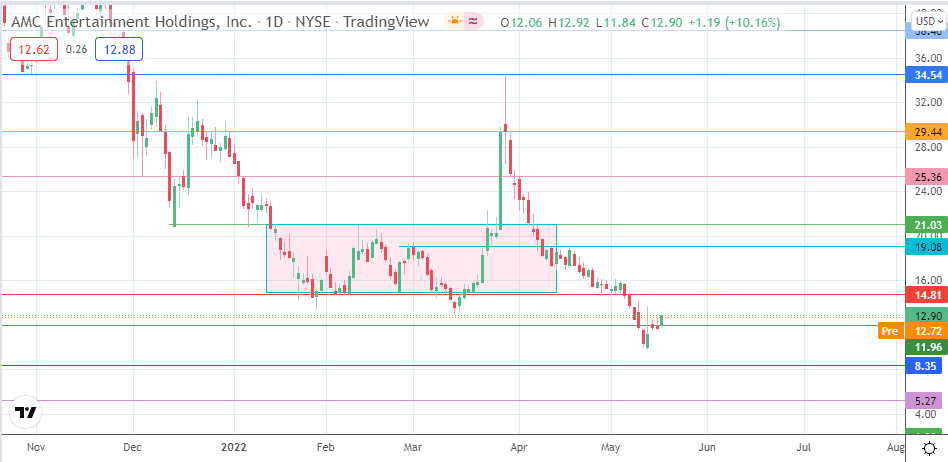

Tuesday’s uptick resulted from a bounce on the 11.96 support level. AN extension of this bounce puts the AMC stock activity on the path of a collision with the resistance at 14.81 (8/24 February low, 6 May 2022 high). Above this level, additional barriers are seen at the 21.03 (10 February high) and 25.36 price marks. 19.08 (1 March and 12 April highs) could potentially be a pitstop.

On the other hand, any rallies could become opportunities to sell at better prices, given the downtrending nature of the price action. Therefore, the bears would be seeking to degrade the 11.96 support to continue the descent.

The 8.35 support level (12 April 2021 low) becomes available if the bearish push breaks below the piercing candlestick pattern’s low at 9.70. A further decline brings 5.27 into the picture (9 February 2021 low). This move brings the stock in tandem with Wall Street’s 12-month price target.

AMC: Daily Chart