- Here is the AMC stock forecast for 2022, 2025, and 2030 and how you can navigate the price changes within these periods.

AMC is the stock symbol of AMC Entertainment, the largest movie theatre chain in the world. It was founded a century ago and was previously known as American Multi-Cinema, hence the abbreviation. The company headquarters is in Kansas, United States.

AMC Stock News

The biggest AMC stock news that can influence today’s buying decisions on the stock is the release of the preliminary Q4 results. The results indicate that sales for the 4th quarter of 2021 surged. In addition, the company expects Q4 2021 revenue to climb to $1.17 billion, compared with $162.5 million a year before, representing an astonishing improvement in its fortunes. AMC also says its net losses narrowed from $941 million for the same period in 2020 to between $114.8 million and $194 million.

This report coincides with the release of a documentary by GameStop about the Reddit short squeeze of early 2021 that sent AMC, GameStop, and other WallStreetBets meme stocks to record highs. The film titled “GameStop: Rise of the Players” premiered over the weekend and told the story of the short squeeze from the standpoint of the retail participants in that event.

AMC Theaters Stock

Before the short squeeze of early 2021, most people had never heard of AMC Entertainment. However, a group of retail investors in a Reddit group known as WallStreetBets brought this stock to the limelight. These retail players got together and simultaneously purchased AMC’s stock and other stocks such as those of GameStop, countering the short positions of a hedge fund that had bet against the company’s stock.

AMC’s stock at the time was in bad shape as the company’s fundamentals looked grim. Its revenue for 2020 had plunged 77%. It had lost $1.5billion and had lost money for four out of the previous nine years. Moreover, attendances at its entertainment centres were dropping steadily even as the entire movie theatre industry in North America declined. Undoubtedly, the hedge fund’s call was the right one. But the WallStreetBet group had other plans. Its decision to squeeze the institutional short positions led to a surge in the AMC stock price. At some point, the AMC after-hours stock price surged 2,000%.

Since then, the stock has given up most of those gains, and it is back at its 15 March 2021 price peak.

Will AMC Stock Go Up?

The stock market operates in trends. There are always periods of accumulation, distribution and all that happens in between. Therefore, when answering the question, it is best to consider whether AMC has ever had positive potential, what caused the stock to plunge, and what factor could aid recovery.

AMC’s business model is to attract viewers to its cinemas and entertainment halls, where they can watch the latest movie releases. The coronavirus pandemic badly hit AMC’s business model. Since then, the numbers have shown some improvement. The timely release of the latest in the Spider-Man movie series and the Bond film “No Time to Die” in the 3rd quarter of 2021 broke revenue records. This shows a business with improving fundamentals. However, it is now out of the woods yet.

AMC Stock Forecast 2022

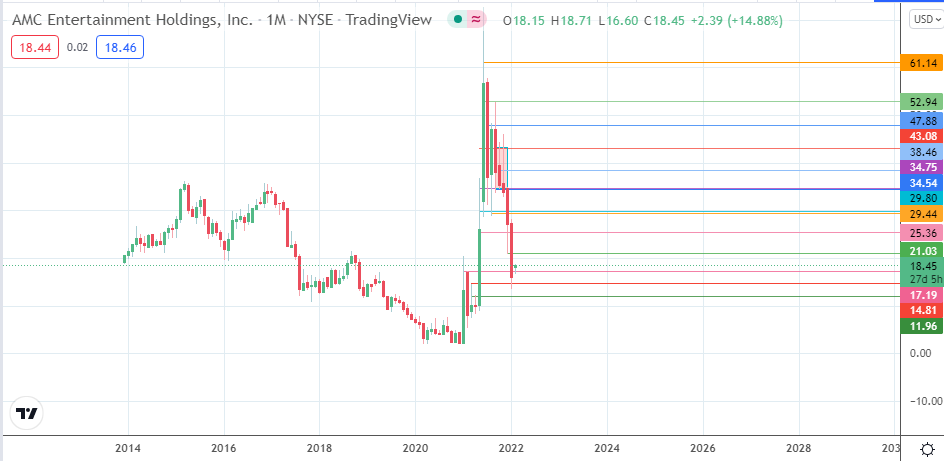

The AMC stock forecast for 2022 is for a potential but muted recovery. However, the stock may witness renewed demand with prices falling so much and presently at relatively attractive levels. The medium-term outlook is showcased on the weekly chart. The price looks set to end six weeks of price deterioration, as the AMC stock price is up 6.64% as at market open on 1 February. This uptick has come off a bounce on the 14.81 price support (15 March 2021 and 17 May 2021 highs).

Additional bullish momentum is required to push towards 17.19 before 21.03 and 25.36 become other targets to the north. Conversely, if the bullish momentum is weak and the 14.81 support mark gives way, bearish AMC stock price forecasts for 2022 may emerge.

AMC Stock Forecast 2025

The reality of the AMC stock price forecast 2025 is that the meme stock has to go beyond just being a meme stock and drive value for shareholders before it can get anywhere near the highs of 2021.

AMC: Weekly Chart

Barring any surprises from the pandemic end, the AMC stock forecast for 2025 is expected to be mildly bullish. However, any bullishness is expected to be muted, with the previous highs of 2 March 2015 and 1 November 2016 at 34.69 expected cap recovery. There may be a prolonged period of price stagnation before any real attempts at forcing the upside. Expect price action to trade anywhere from $17 to $35 during this period.

AMC Stock Forecast 2030

If you buy AMC at its lowest price in 2022, whatever that price may be, one factor will stand between you and making money by 2030: the impact of the Metaverse on how human beings choose to be entertained. The AMC stock forecast 2030 must consider whether people will prefer to wear headsets and connect to the Metaverse for entertainment or still physically attend theatres. The ability of AMC to adapt its business model to match these new realities will also determine whether the AMC stock forecast for 2030 will exceed $35.

Is AMC a Good Stock to Buy?

Considering the extent to which price action as retraced on the AMC share price, and the return of consumers’ pent-up demand to the company’s entertainment centres, AMC seems to be an excellent stock to buy for medium-term and long-term investors.

Here are three factors that support a buy decision on AMC stock price today:

a) The Omicron variant has proven to be a mild one and did not lead to new lockdowns. This is a huge plus.

b) AMC was only fully open for business in Q3 2021 after being shuttered for 2020 and most of 2021. However, solid earnings from the movie screenings pushed up its cash equivalents to $1.6 billion in Q3 2021.

c) AMC cut down its cash burn as 2021 progressed by nearly 70%.

You can check also: Nio Stock Price Forecast.

Investment decision intelligence and analytics firm Morning Consult did several surveys to track pent-up demand and other indices which measure whether moviegoers are heading back to the cinemas or are more comfortable with online streaming services. They found the following:

- comfort with going to the movies is ticking upwards, with a 1% point gain in the index to 44% in January 2022.

- the share of consumers who are already going to the movies rose two percentage points to 18%.

- 16% of adults feel ok to head back to the movies in February 2022, down by four points from the previous week.

These results show that AMC Entertainment can expect a slow and gradual recovery in its business, but investors who want to buy this stock must be prepared to dig in and ride any upticks for the long haul.

Summary

Many retail investors tend to buy stocks when the prices are already on the way up. They fail to realize that institutional investors buy at low prices, and interest is virtually zero. This is the present position of the AMC stock price. The AMC Entertainment stock price is presently at such levels. There is a good case to invest in AMC Entertainment, but it has to focus long-term as the company continues to navigate its way out of the pandemic.

AMC: Monthly Chart

Follow Eno on Twitter.