- Summary:

- The AMC stock forecast indicates that the bearish pennant could still play a role in near-term price action.

The AMC stock forecast remains negative, despite the strong uptick

seen in Thursday’s trading session. The stock had gained 15.19% on the back of the increased retail investor interest. In addition, the stock trended well on Stockwits and got a significant mention on the WallStreetBets Reddit subgroup.

AMC Entertainment’s CEO Adam Aron has vowed to crush traders shorting his stock. His modus operandi in 2021 was opening new movie theatres and branching into alternative programming. This strategy did not work, as the stock saw heavy selling that has sent it well below its 2021 highs.

Aron has said he will unveil his new strategy after the Q2 2022 earnings call on 4 August. However, how this will be achieved remains to be seen, especially as Citi Group maintains a bearish outlook on the stock, with a price target that has been lowered from $6 to $5.

The stock has opened Friday’s session with a bearish gap which the bulls are covering gradually. As a result, the AMC stock price is 1.80% lower as of writing.

AMC Stock Forecast

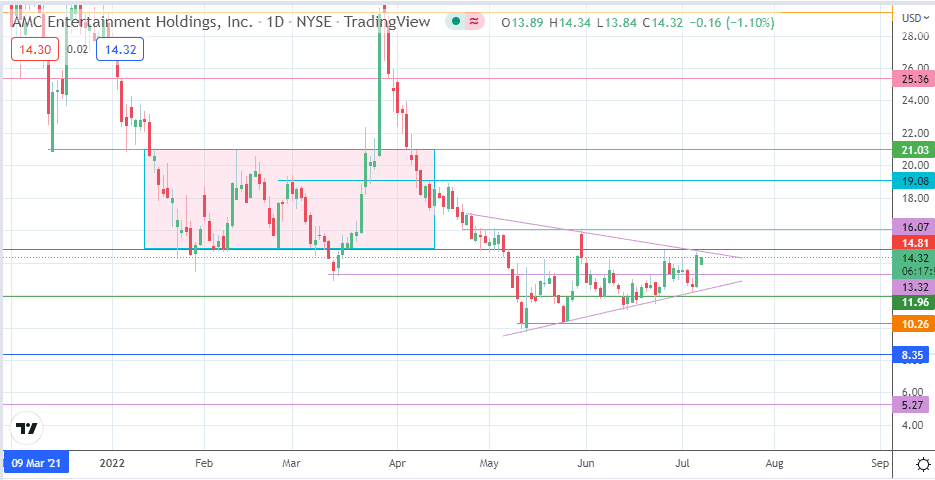

The chart pattern on the daily chart is the bearish pennant, which currently has the price action testing its upper border. A break of this border at the 14.81 resistance level invalidates the pattern and opens the door toward the 16.07 barrier (28 April – 4 May and 31 May 2022 highs). A further advance gives the bulls clear skies to target the 19.08 resistance (12 April high). Additional barriers to the north are seen at the 21.03 location of the 10 February and 21 April highs and at the 6 April high located at the 22.00 psychological price mark.

On the flip side, a retreat from the 14.81 resistance has to take out the 13.32 support level (22 June high and 1 July low) before it can test the lower border of the pennant at 11.96. A breakdown of this border points to a measured move to as low as 5.27, a multi-year low seen on 17 February 2021. However, before the bears can attain this point, they need to sequentially break down downside barriers at 10.26 (24 May 2022 low) and the 12 April 2021 low at 8.35.

AMC: Daily Chart