- Summary:

- The AMC stock forecast could soon turn bullish of the break of 11.92 occurs, completing the falling wedge pattern.

The recent declaration by AMC Entertainment Holdings Inc on its revenue levels could spur bullish AMC stock forecasts if the bulls manage to turn this into something positive. The stock gained 3.83% in Tuesday’s trading after the company said its recent global revenue from theatre admissions exceeded levels seen at the same weekend in 2019 by 15%.

This revenue jump was due to the highly successful screening of the sequel to Tom Cruise’s 1986 film, Top Gun. Also, the recent launch of “Jurassic World Dominion” appears to have helped these numbers, making the weekend in review the second busiest in 2022.

More than 4.9 million people have been to AMC theatres to watch a movie, with new releases up for viewing in the next two weeks. The news of the revenue jump appears to have pleased investors, who have been able to push the stock to a higher close, thus ending a three-day losing streak.

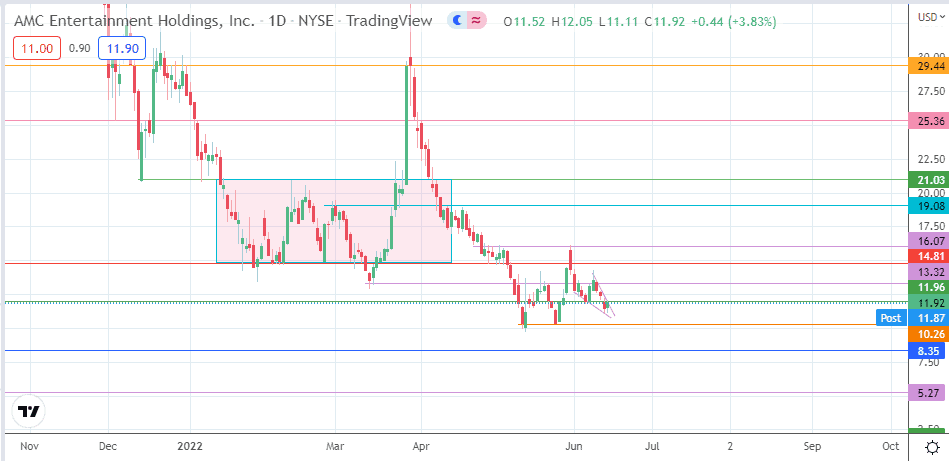

From a technical analysis perspective, the recent correction follows the completion of the measured move of the double bottom of 12 May and 25 May 2022 at 16.07 (31 May high). This corrective move broke below the pattern’s neckline at 13.32 and violated the support at 11.92 the second time of asking. With the price activity now attempting a return move at this violated price mark, what is the AMC stock forecast for the rest of the week?

AMC Stock Forecast

Rejection of the return move at 11.92 confirms the breakdown of this price mark and its reversal of roles as new resistance. Selling pressure at this point sends the price action towards the 10.26 price mark, site of the troughs of the double bottom pattern. A subsequent breakdown of this level targets 8.35 (13 April 2021 low), with the prior low of 9 February 2021 at 5.27 serving as an additional harvest point for bears aiming to profit from the rejection at 11.92.

On the flip side, the breach of 11.92 to the upside restores this price mark as support and completes the evolving falling wedge pattern. This move also opens the door toward the 13.32 resistance as the next upside target. Subsequent barriers to the north include 14.81 (28 April low) and 16.07, where the 31 May high resides. Finally, 19.08 and 21.03 (10 February 2022 and 7 April 2022 highs) are ambitious targets to the north, which are still far off.

AMC: Daily Chart