- Summary:

- The Amazon stock price prediction provided by Deutsche Bank and the upcoming stock split are exciting investors this Monday.

The Amazon share price has opened for trading this Monday on a slightly positive note, notching up an opening gain of 1.17% as of writing. This is a relatively muted open, considering the highly volatile nature of this stock’s price action in the previous week.

Supporting the mildly bullish sentiment is the recent Amazon stock price prediction provided by Deutsche Bank. The investment bank has issued a BUY rating for the Nasdaq-listed technology heavyweight, and has made an Amazon stock price prediction (i.e. 12-month price target) of $4,100. This is slightly above consensus targets of other institutional analysts that currently sits at $4,099.88. This price target gives the Amazon share price a 39.74% upside potential from the current price.

The upgrade in the stock’s outlook follows a decision by the company to split the stock, making it the most affordable it has been in more than a decade. The board of directors has approved a 20-for-1 stock split, which means that all investors who hold one (1) current Amazon share will receive 20 new ones in exchange when the deadline for the split expires. The split follows other companies such as Tesla, Alphabet, and Nvidia. The last Amazon stock split (on a 2-for-1 basis) was in September 1999.

Amazon Stock Price Prediction

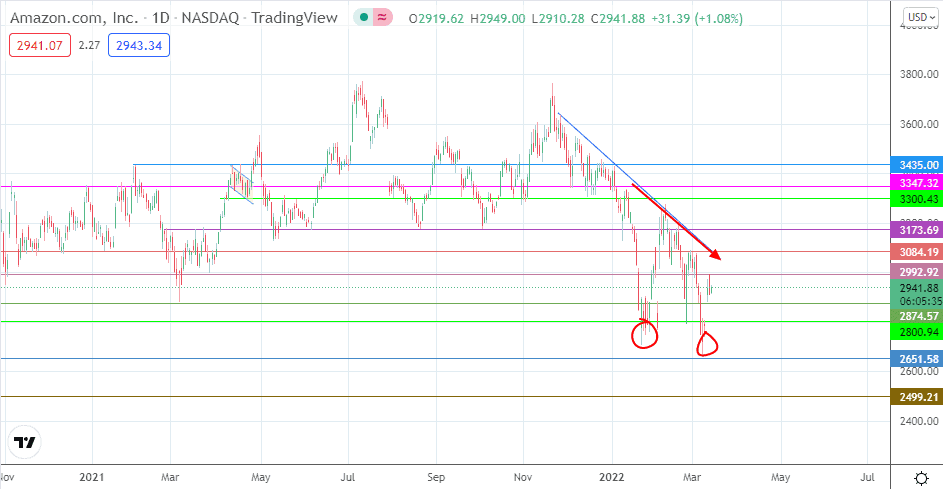

The double top on the daily chart supports the Amazon stock price predictions given by the investment banks. However, the stock needs to push above the identified neckline, which cuts the 3084.19 resistance, to complete the pattern and force a measured move towards 3435.00. To attain completion, this measured move must uncap resistance barriers at 3173.69, 3300.43, and 3347.32.

On the other hand, rejection at the 2992.92 resistance, currently being challenged, allows for a potential pullback towards 2874.57. 2800.94 and 2651.58 are additional targets to the south. The bulls would then be counting on dip-buying to restore the upside momentum on the pair.

Amazon: Daily Chart

Follow Eno on Twitter.