- The Amazon stock price forecasts could take a bullish turn as the 20-for-1 stock split makes the stock price attractive.

Amazon stock price forecasts may soon turn bullish following its first stock split in 23 years. But why is the stock split critical to new Amazon stock price forecasts? Bank of America has studied stock splits of 500 companies since 1980 and discovered that they provided an average return of 25.4% in the 12 months after the split. This beats the S&P 500’s 9% returns in the same time frame.

You may not look too far. For example, Tesla did a 5-for-1 stock split in August 2020, and they ended up doubling in price by November 2021, 15 months later. Likewise, Amazon performed a 20-for-1 stock split over the weekend, giving shareholders 19 additional shares for every Amazon share previously held.

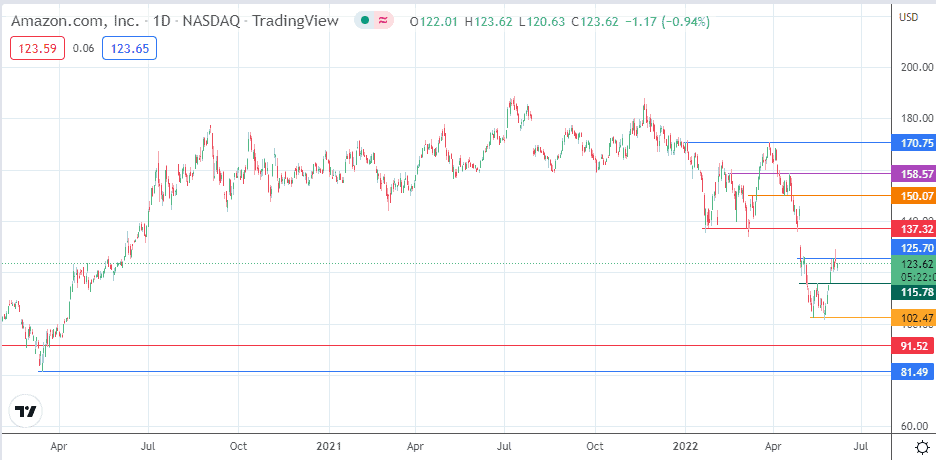

The stock split caused the Amazon stock price to drop from $2,447 per share to $122 for each stock. Since the split, the Amazon stock price has not done much in price appreciation, but it is still early days. A break of a key resistance at $125 could fuel new Amazon stock price predictions to the upside. The Amazon stock is trading 0.99% lower as of writing.

Amazon Stock Price Prediction

Following the completion of the measured move from the double bottom at 125.70, the stock formed a pinbar at that resistance, leading to a lower open and the potential for a correction in the stock. Extension of the rejection to the downside retests the neckline of the completed pattern at 115.78 (17 May high). 102.47 and the 10 March 2020 low at 91.52 form additional downside targets. 81.49 completes potential near term targets to the south.

On the other hand, a break of 125.70 allows for a push toward 137.32 (26 January and 9 March lows). This move covers the 29 April bearish gap. If the bulls uncap the 137.32 barrier, 150.07 is a psychological resistance and the 13 April low point that becomes the next upside target. The 19 April high at 158.57 also forms an additional target to the north.

Amazon: Daily Chart