- What is the outlook of the Amazon share price? We explain what to expect and the two main catalysts to move the shares up.

The Amazon share price has staged a remarkable recovery in the past few days as investors buy the dips after the decision to split. AMZN stock is trading at $3,302, which is 23% above this month’s lowest level. It has even outperformed the Nasdaq 100 index and other FAANG stocks. As a result, its valuation has climbed to over $1.67 trillion.

The Amazon stock price has been in a strong rally as investors remain optimistic about the company’s recovery. Indeed, most analysts have been bullish about the shares. For example, analysts at Deutsche Bank initiated their coverage with a buy rating. They expect that the stock will rise to $4,100. The most optimistic analysts are from UBS, who expect the shares to surge to $4,625. Others with a positive view of the company are from Tigress, Wolfe Research, and Cannacord Genuity.

Amazon’s business is being helped by its diversification. While its retail business will be affected by the rising inflation, its cloud business is expected to experience substantial growth in the cloud division. In its most recent quarter, the company said that its AWS revenue in Q4 rose to $17.8 billion from $12.7 billion in the same quarter in 2020. As a result, the business delivered $62.2 billion for the year. Its profit rose to over $5.2 billion in Q4 and $18.5 billion in 2021.

With interest rates set to rise, investors seem to be pricing in a situation where large-cap companies like Amazon and Alphabet will keep doing well. Another important catalyst for Amazon share price is its growth in the ad business. With Meta Platforms having challenges, many advertisers will turn to Amazon. Indeed, it generated over $31.1 billion in revenue in 2021 in its ad business.

Amazon share price forecast

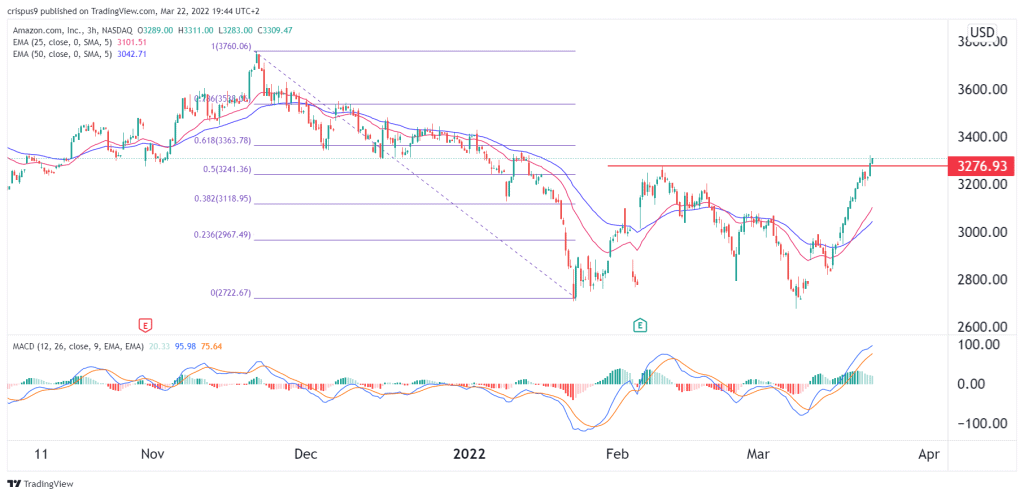

The three-hour chart shows that the AMZN share price has been in a spectacular comeback in the past few weeks. And on Tuesday, the stock managed to move above the key resistance level at $3,276, which was the highest level on February 9th. In addition, it has moved above the 25-day and 50-day moving averages and the 50% Fibonacci retracement level.

Therefore, the Amazon stock will likely keep rising as bulls target the next key resistance level at $3,500, along with the 78.6% retracement level. This view will be invalidated if it drops below $3,000.