- Amazon share price finds itself in an enticing position with a bullish sentiment around its earnings and a potential mention of its robotaxi.

Amazon share price was marginally up in Tuesday’s pre-market session, driven by an upbeat sentiment surrounding its forthcoming earnings release. The stock was above Monday’s closing price of $187.54 by 0.1 percent at the time of writing, signaling a potential reversal.

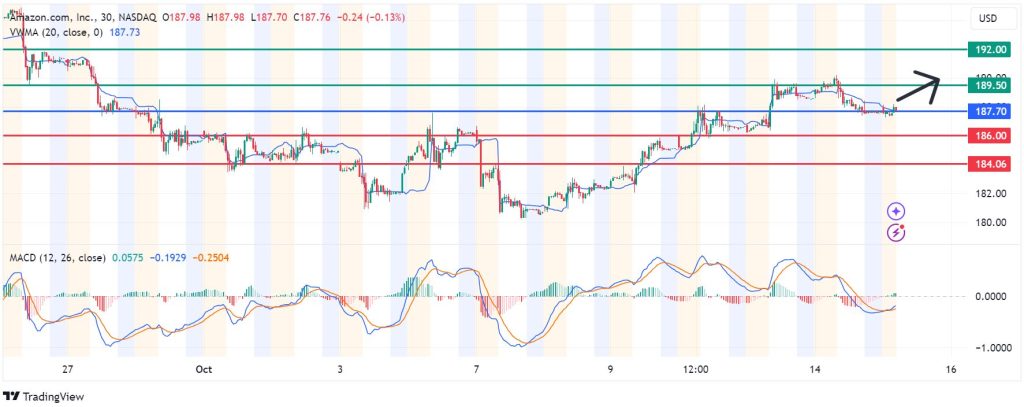

The underlying momentum on Amazon (NASDAQ: AMZN) is bullish, having risen by 3 percent in the last five trading sessions. In addition, it has gained 27 percent year-to-date. However, the stock is currently below the Volume Weighted Moving Average (VWMA) on the daily chart, which is at $188.03 as of this writing. That signals downward pressure from the bears, which could limit near-term gains.

What could move AMZN share price?

Amazon will announce its fiscal third quarter earnings on October 24, and Wall Street analysts forecast a 9 percent growth in revenue YoY to $157 billion. The e-commerce giant reported an EPS of $0.94 in Q3 2023 quarter, and that is expected to grow to $1.14 this quarter. The fiscal 2024 earnings per share are expected to grow by 70.8 percent to $4.85. These figures signal an upbeat sentiment around the stock, setting the stage for near-term gains.

Meanwhile, the company could also give a progress report on its robotaxi venture, which is spearheaded by Zoox, a subsidiary it acquired in 2024. Amazon is expected to go head to head against Alphabet’s Waymo and Tesla’s recently-revealed Robocab. In vestors will be keen to weigh how far Amazon has advanced against its rivals, and that could inject fresh volatility into the Amazon share price.

Amazon share price analysis

Amazon share price pivots at 187.70, and the upside could prevail if the bulls keep the price above that mark. The upward momentum could encounter the first resistance at 189.50, but a stronger push could break above that level to test 192.00.

On the other hand, moving below 187.70 will signal the onset of bearish control. If that happens, initial support could be established at 186.00. However, an extended bearishness could break below that level, invalidating the upside narrative while extending the downside to test 184.06