- Summary:

- Alibaba stock price has staged a strong recovery as investors buy the dip of China’s fallen angel. BABA shares have rallied

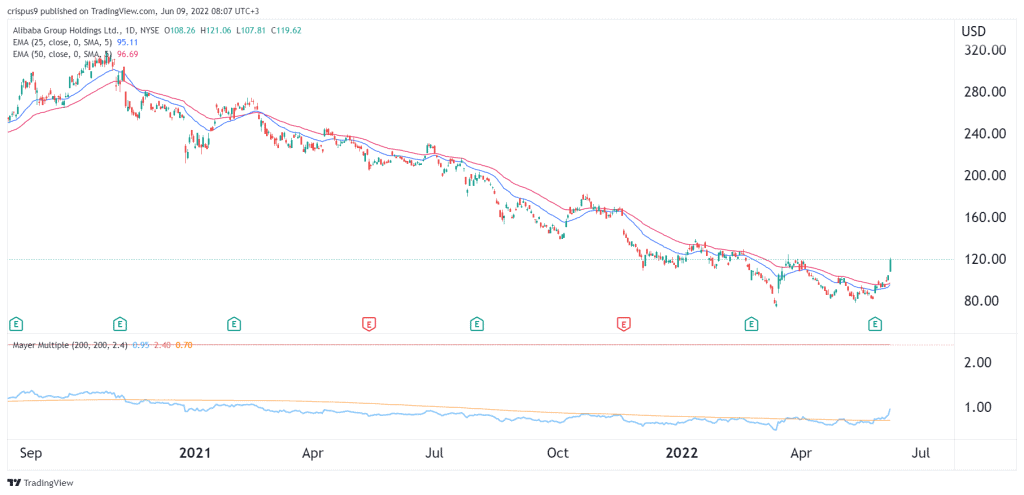

Alibaba stock price has staged a strong recovery as investors buy the dip of China’s fallen angel. BABA shares jumped by more than 13% in New York on Wednesday. They are also the best performers in Hong Kong. The stock is trading at $120, which is the highest it has been since March 2022. It has risen by 63% from its lowest level in March, bringing its market value to over $265 billion

Why is BABA soaring?

Alibaba and other Chinese stocks have had a difficult time. In the past few months, stocks of companies like JD.com, Tencent, DiDi, Baidu, and Tal Education have crashed by more than 50% from their all-time high. This performance has happened because of the harsh policies of the Chinese communist regime. In the past few years, Xi Jinping has imposed tough regulations on the sector.

Now, with the Chinese economy slowing ahead of the Communist party general meeting, the government has started showing its flexibility. For example, this week, the government’s regulators approved a license for domestic video games. And last week, they moved to wind up their probe on DiDi, the ride-hailing company. As a result, it can now onboard new customers.

I believe that the sell-off has made the Alibaba stock price highly undervalued. The company is now valued at over $265 billion even though it is more profitable than Amazon, a company valued at over $1 trillion.

For example, Alibaba has been profitable for all years since 2012. Amazon became profitable only in 2015. Since 2015, Amazon’s profits have been $81 billion. Alibaba’s profits have been close to $100 billion in the same period. This means that Alibaba is significantly a cheap stock amid a regulator clarity.

Alibaba stock price forecast

Alibaba share price has been in a strong recovery in the past few weeks and is now trading at the highest level since March. It has moved above the 25-day and 50-day moving averages while the Mayer Multiple has tilted upwards, which is positive. The stock is attempting to move above the key resistance level at $123.

Therefore, while there are risks, I believe that the BABA stock price will continue rising in the coming months. If this happens, the next key resistance level to watch will be at $200, which is about 70% above the current level. A drop below $90 will invalidate the bullish view.