- Summary:

- The strong bounce on the 82.57 support level gives support for the Alibaba stock price forecasts of a recovery to $98.

After five days of declining prices, the Alibaba stock forecasts are starting to look up, thanks to a positive start to the New York session. The Alibaba stock price is up 8.37%, following up from its 2.8% gain in Hong Kong trading.

The stock got a boost after Reuters quoted Chinese government officials as saying that a lockdown of Beijing was not on the table, even as some districts looked set to face tighter curbs. Shanghai is in its 7th week of lockdowns, and a few days ago, some officials had hinted at the potential for tighter curbs as Beijing continues to push its zero-COVID policy aggressively.

Investors are also expressing optimism for a positive outcome from the forum between China’s biggest tech firms and the Chinese People’s Political Consultative Conference, the country’s top political advisory body. Bloomberg is reporting that the meeting, which will be held next week, will focus on developing China’s digital economy. Cues for a potential wind-down of the tough regulatory crackdowns of 2020-2021 will also be on investors’ minds. Positive developments from the meeting will boost Alibaba stock forecasts.

Alibaba Stock Forecast

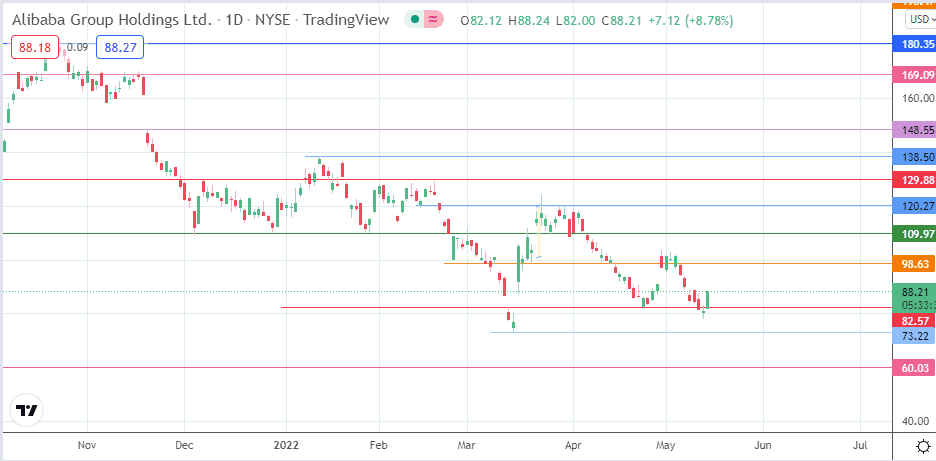

On the daily chart, the intraday bounce on the 82.57 support level (25 April low) looks set to complete the morning doji star pattern. This has bullish implications, and the uptick will bring the price to the 98.63 resistance (14 April and 5 May 2022 highs). A break of this level is required to take the price action further north, with the 1 March and 6 April highs at 109.97 set to serve as the immediate resistance.

Above this level, additional northbound targets are seen at the 120.27 (30 March high) and 129.88 (7 December 2021 and 19 January highs) price levels. Only when 138.50 is broken can the Alibaba stock price experience a reversal of the trend.

On the other hand, a further decline is seen if the bears are able to degrade the support at 82.57. This action would make the 15 March 2022 low at 73.22 available as the next downside target. The 60.03 multi-year support (15 September 2015 and 12 February 2016 lows) comes into the picture if further price deterioration occurs.

Alibaba: Daily Chart