- Summary:

- What is the forecast for the Algorand price as on-chain data shows that activity was starting to slow? We explain what to expect.

Algorand price is loitering near its lowest level since February 2021 as demand for the coin eases. ALGO, the network’s native token, is trading at $0.6717. This price is about 76% below the highest level in 2021. However, it is also an important level since the price has struggled to move below this support several times. Algorand has a market cap of about $4.4 billion.

Algorand is one of the many Ethereum-killers around. One of its most important attributes is that the network has an emphasis on climate change. Every carbon that is generated in the platform is offset using blockchain technology. It uses ClimateTrade, a network built using Algorand, to rack offsets on a blockchain. During the weekend, the developers also acquired advertising space in Time Square in celebration of Earth Day.

While Algorand has been rated well, there are signs that the network is slowing. For example, DeFi Llama tracks just seven projects built using the platform. These apps have a total value locked of $167 million, and Algofi has a dominance of 59%. Tinyman and Pact have a TVL of over $32 million and $19 million, respectively. On-Chain data also shows that volume has continued dropping. The average balance in accounts has also dropped. As shown below, other key gauges like realized cap and MVRV ratio have also retreated.

Algorand price prediction

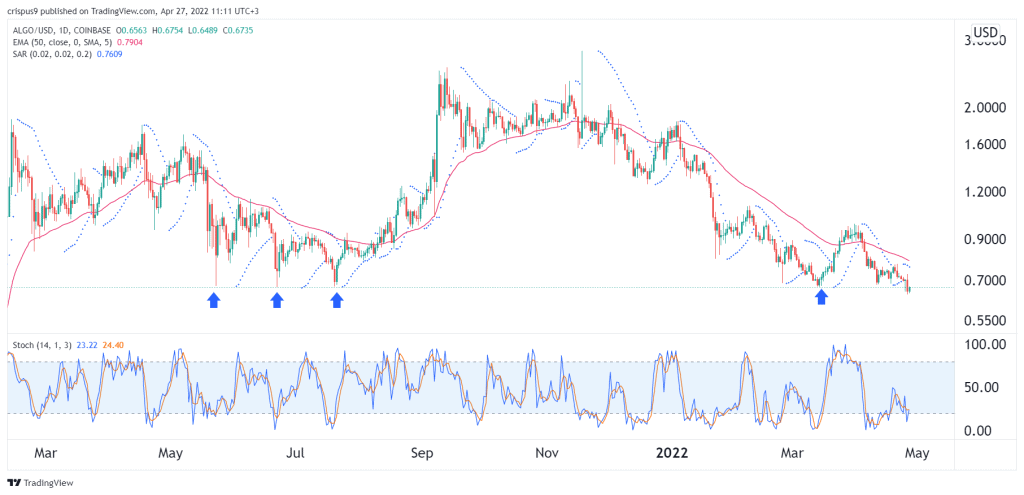

On the 1D chart, we see that the Algorand price is trading at an important support level. It has struggled moving below this level since May last year. The price has moved below the 25-day and 50-day moving averages. It has also moved below the dots of the Parabolic SAR indicator, while the Stochastic oscillator has moved below the oversold level.

Therefore, a clear break below this support level will signal that bears have prevailed. As a result, the coin will keep falling as investors target the key support level at $0.50.