- Summary:

- The ADA price is stagnating in a narrowing descending triangle pattern which suggests a violent move may be on the horizon.

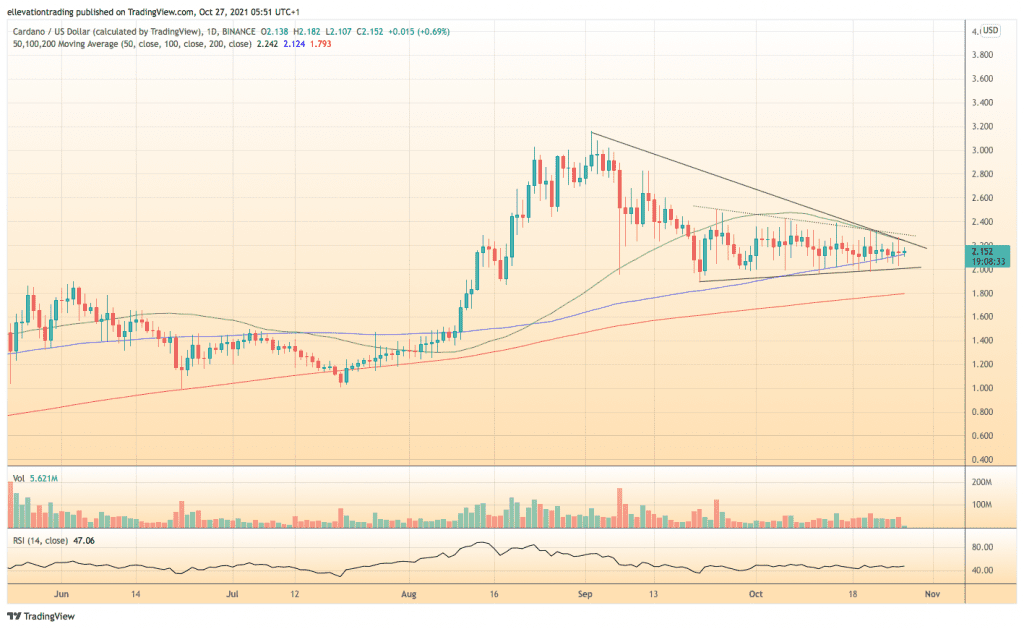

The ADA price is stagnating in a narrowing descending triangle pattern which suggests a violent move may be on the horizon. Cardano (ADA) is trading at $2.15 (+0.60%), +1.66% in October and +1,100% year-to-date. Cardano’s market cap is stable at $71.5 billion, ranking it the fourth-largest cryptocurrency, behind Binance Coin (BNB).

Cardano has struggled to regain its bullish momentum despite fireworks exploding across the cryptocurrency market. Last week, Bitcoin (BTC) set a new record of $66,999, and Ethereum (ETH) is on course to achieve the same. Despite this, ADA has been remarkably quiet and continues to grind sideways in a tight range. The cause of Cardano’s poor performance is likely due to the success of its closest rivals. Whilst, the network was once thought to be the biggest threat to Ethereum, Solana is gaining traction as the number-one Ethereum killer. As a result, the optimism surrounding the ADA price is waning. Nonetheless, the recent price action will soon lead to a range breakout. In that event, ADA might be in for some fireworks of its own.

Cardano Price Forecast

The daily chart highlights Cardano’s inactivity. Below the market, the 100-DMA at $2.21 is the first support level. Following that, a rising trendline that makes up the bottom of the descending triangle offers additional coverage at $2.01. On the upside, a descending trendline aligns with the 50-DMA to provide considerable resistance at $2.24.

Successful uncapping of trend resistance should clear the path to $2.50. Furthermore, if the broader market continues to attract capital, the ADA price could exceed $2.50 and extend towards the ATH at $3.13. However, if Cardano drops below trend support, bearish momentum should increase, targeting the 200-DMA at $1.80. For now, either scenario is plausible, and for that reason, I’m neutral until the price breaks free from the triangle.

ADA price Chart (Daily)

For more market insights, follow Elliott on Twitter.