- Summary:

- A third session of rising US long term bond yields is driving selling on the S&P 500 index, as bears dominate proceedings in the US markets.

As the S&P 500 index continues to take the brunt of the rise in US bond yields, a strategist at the Bank of America has raised the year-end target of the S&P 500 index to 4200, with a year-end 2022 target of 4600.

At the current price, the valuation seems to leave the S&P 500 index with some room to manoeuvre to the downside while nearly capping the upside move.

US stocks continue to fall with the rise in US 10-year bond yields, while the JOLTS job openings data from the Bureau of Labor Statistics show that hiring fell from 6.8 million in June to 6.7million, creating new job openings by more than 700,000 in the previous month. The data shows that businesses still cannot fill positions.

S&P 500 Index Outlook

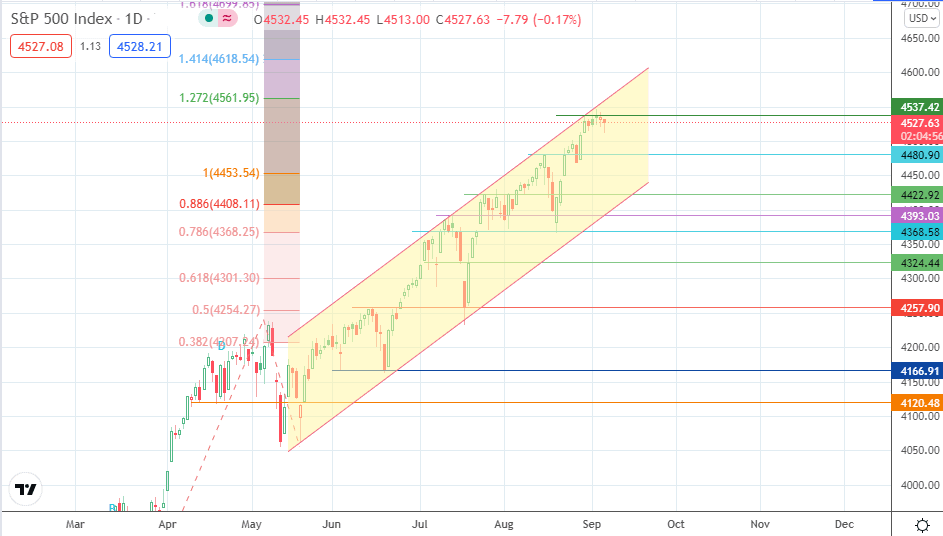

As indicated in yesterday’s analysis, the 4537 resistance barrier remains intact, with an extension of Tuesday’s selloff now pushing the index closer to the 4480 support. A breakdown of this support is required for additional downside targets at 4422 and 4393 to come into the picture.

On the flip side, the bullish continuation of the S&P 500 index requires a break of 4537, opening the pathway towards the 127.2% Fibonacci extension at 4561 as a potential next target. Further north, a resistance barrier may also appear at the 141.4% Fibonacci extension at 4618, with 4600 as an intervening psychological barrier.

S&P 500 Index: Daily Chart

Follow Eno on Twitter.