- Summary:

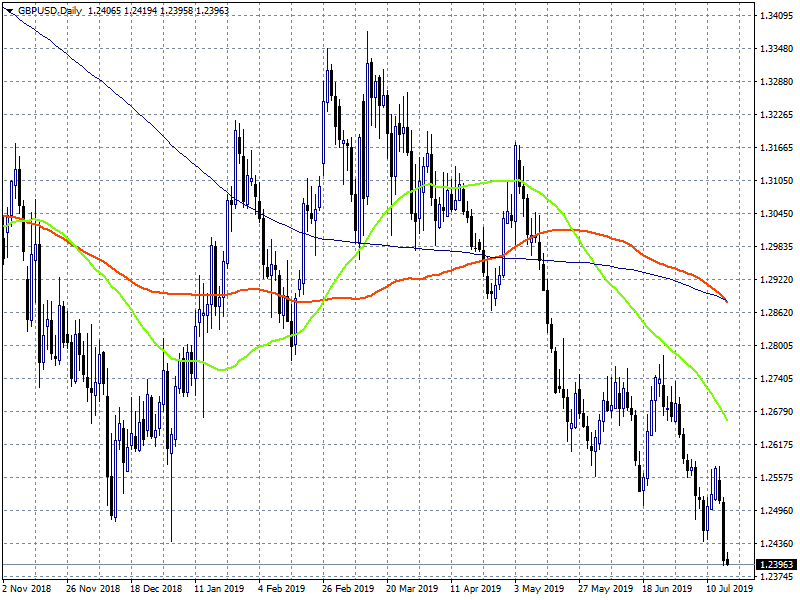

- Bears are in full control here and yesterday the pair tested the 1.24 mark. GBPUSD yesterday failed to capitalize the better wages report

Bears are in full control here and yesterday the pair tested the 1.24 mark. GBPUSD yesterday failed to capitalize the better wages report and that gave the sellers the opportunity to send the pair to an area that we haven’t seen since April 2017. The UK May average weekly earnings came in at +3.4% vs +3.1% 3m/y expected. UK Average Earnings Excluding Bonus came in at 3.6% (3Mo/Yr) better than expectations of 3.5%) in May. United Kingdom Claimant Count Change came in at 38K beating forecasts of 22.8K in June. The United Kingdom Claimant Count Rate rose from previous 3.1% to 3.2% in June. The UK ILO Unemployment Rate (3M) came in at 3.8% as expected. The BOE Monetary Policy Committee member Sir Jon Cunliffe noted that he had not a strong sense that people are seeing big drops in demand and added that he didn’t see the economy shrinking.

The pair currently trades flat at 1.2410 having hit the low at 1.2401. In case that the pair breaks below the 1.24 level the next support stands at 1.2371 the low from 10 April 2017. A break below will intensify selling down to 1.2108 the low from 12 February 2017 and then at 1.1986 the low from 15 January 2017. On the upside immediate resistance stands at 1.25 round figure and then at 1.2520 the daily high and if the pair manages to close above it might continue with an attempt to 1.2530 the 50 hour moving average. Traders will hold their short positions as long as the pair holds below the 1.25 mark, while a try for bottom fishing will emerge at 1.2370.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.