Summary:- Learn how to trade trend with a trend following strategy using breakouts. The strategy can be used when trading Forex, but also indices, and commodites.

A trend following strategy using breakouts tries to catch a new trend as soon as possible, riding it until it is confirmed that the trend is about to reverse. Thus, the essence of trend following strategies is always to “stay inside a trend”. However, for those of us who have missed the initial move, there are still ways available to enter a trade. Trading breakouts or breakdowns, as well as pullbacks, are a great way of achieving that.

A Simple Way to Trade a Trend

One of the most simple and less ambiguous way of entering into the direction of an underlying trend, is to trade breakouts and breakdowns out of resistance and support levels, respectively. I call it less ambiguous because it is usually very clear what is an important low or high in a chart. Trading breakouts is possible even if you miss the start of the trend.

Trading a Breakout or Breakdown

To do this, you first need to determine the direction of the trend. It should be noted that uptrends form fresh higher highs as well as higher lows, as opposed to downtrends which form fresh lower lows and lower highs. You can use any trading platform to try and identify these characteristics that identify uptrends and downtrends. Some people will apply trend lines and moving averages, but I like to keep it simple and just look at the chart to figure out if the price trending up or down. Also, trendlines and moving averages are lagging and not leading indicators.

There is an old, and simple test to figure out a trend. Just ask a child if the price is declining, ascending, or oscillating. A quick an clear answer will tell you what you need to know, while if you need to spend time figuring out the trend then there is probably no bias.

The definition of a downtrend states that the trend will be downwards if the price is creating lower lows and highs, however, I always place more emphasis on the highs rather than the lows in a downtrend. In an uptrend I do the opposite i.e. I focus on the lows and ignore any lower highs until the trend turns around.

In the case of uptrends, each HH (Higher High) is indicative of a form of resistance for the price. Normally this price must break the resistance level over and over again while it moves upward. New Higher Highs are also formed, which are facilitated by the break of the previous Higher High, indicating that the uptrend is still intact. In an uptrend, the trader will buy the break to a prior important high, and place the stop-loss order at the latest significant swing low, which is also the trend defining level, and the level if breached will end the uptrend. A level that will affect the majority of traders is more important than the breach of a level that will influence the few.For more on this, please continue reading but also read:

What is a Trend Following Strategy?

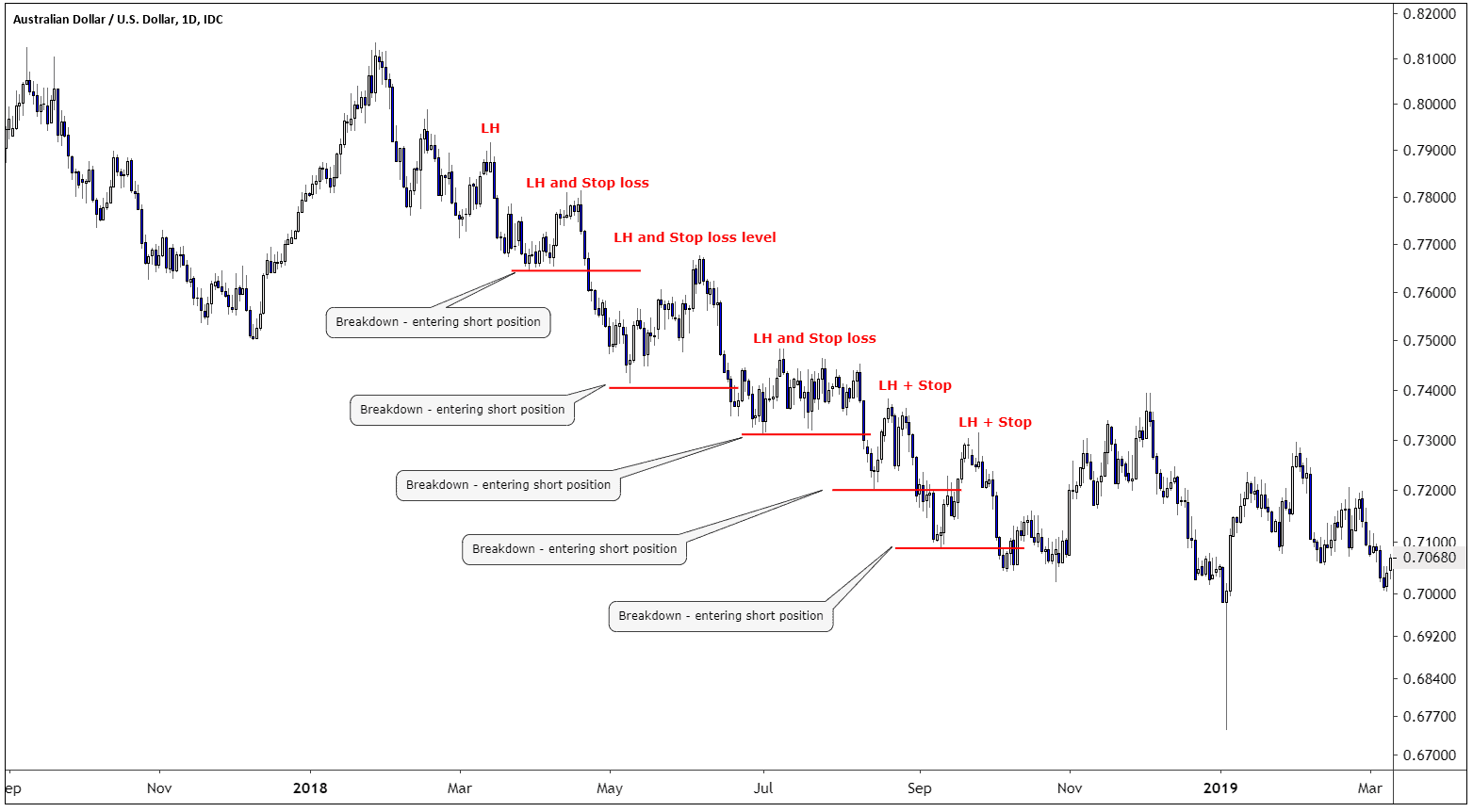

In a downtrend, traders enter in the direction of a downtrend by trading the break of the previous lower low (LL), subsequently placing a stop-loss order above the new LH (lower high). The following chart shows how to enter into a trade. As we can see from the chart below, a genuine downtrend will provide several opportunities to short-sell. However, the challenge with trend trading is that there will be a quiet period in most financial instruments for most of the years. One way of solving for this problem is to trade more than just one asset class, and also trade most instruments within each asset class, barring that we ignore markets that are not prone to trending.

Breakdown entries in a down trend

Don’t miss a beat! Follow us on

Twitter.