- Summary:

- Gold price steady as markets await comments from US Fed Chair Powell in France, and FOMC member Charles Evans on CNBC. Bull flag breakout in the works.

Today’s Gold price continues to hold steady above the 1410 price level. Trading for the week has been restricted to a very narrow range. This range has oscillated between 1407 as price floor and 1417 as price ceiling.

Gold price watchers are looking to two events. First is the speech on “Aspects of Monetary Policy in the Post-Crisis Era” from US Fed Chair Jerome Powell at the French G7 Presidency today at 1pm EST. The seconds is the CNBC interview to be given by FOMC member and President of the Federal Reserve Bank of Chicago, Charles Evans. Evans takes the stage at 3.30pm EST.

The comments to be made by both men are expected to solidify the Fed’s stance on the interest rate policy of the US, which is expected to cause some volatility in the USD as well as gold prices.

Technical Setup

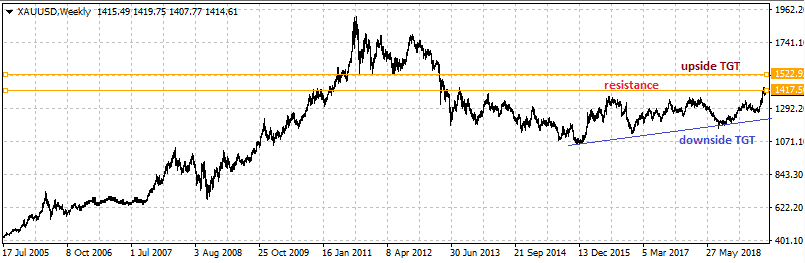

The Gold price daily chart reveals the presence of a bullish flag setup. Dovish comments by both Powell and Evans will provide the impetus for gold prices to push beyond the flag in a bullish continuation move. If this should occur, we can expect prices to push up to the upside target of 1522.92 and this would complete the bullish continuation price projection from the bull flag.

To the downside, the ascending trendline maintains support on the weekly chart at 1300 price area. If the bull flag fails to deliver, this would be the next medium-term target.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.