- Summary:

- Key news releases for the United Kingdom expected this week. UK employment data, consumer inflation and retails sales in focus.

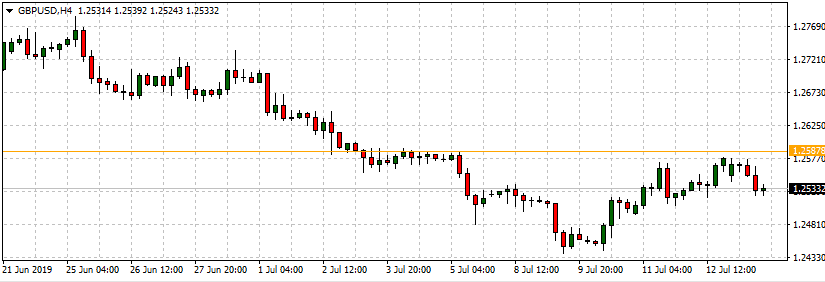

Traders will be watching the Cable this week as a slew of economic data will hit the newswires. Kicking off the news releases for the United Kingdom will be the employment data on Tuesday July 16, followed by the Inflation Report on Wednesday. The retail sales report will be released on Thursday and will complete this week’s tradable news data for the United Kingdom.

Unemployment Data

Three sets of employment data will be released:

- The Claimant Count Change

- Unemployment Rate

- Average Earnings Index (2nd quarter)

The Average Earnings Index will have the greatest market impact, with a consensus figure of 3.1% (same as last release). Therefore, a deviation of 0.1% to the upside will be good for the GBP, and a deviation of 0.1% to the downside will be bad for the GBP. This is a leading indicator for consumer inflation.

Consumer Inflation

At 8.30am UTC, the newswires will be abuzz with the Annualized CPI data. The market consensus is 2.0%; the same figure as the last release. A 0.1% deviation may cause some volatility on the Pound. A reading of 1.9% or less will be GBP negative, while a reading of 2.1% and above will be GBP positive.

Retail Sales

Thursday July 18 will see the Retail Sales figure released for the month of June at 8.30am UTC, The markets are expecting a -0.3% reading (an improvement on the previous figure of -0.5%). A less negative reading will be GBP positive, while a more negative figure will be GBP negative. A deviation of at least 0.3% is required to make this piece of data tradable.

Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.