- Summary:

- GBPUSD lost momentum after the US Core CPI which came in at 0.3% m/m, and headline CPI m/m came in at 0.1%. The pair hit the daily high

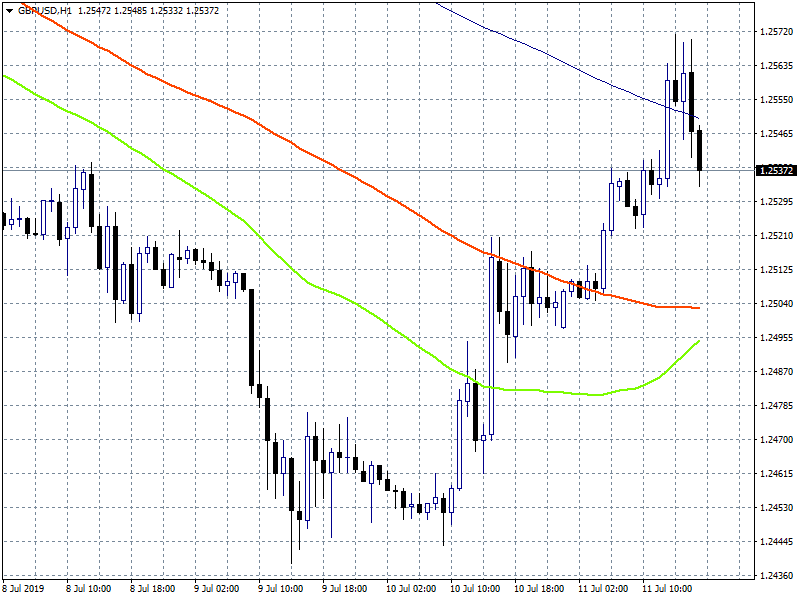

GBPUSD lost momentum after the US Core CPI which came in at 0.3% m/m, and headline CPI m/m came in at 0.1%. The pair hit the daily high at 1.2571 but after the buyers run out of steam, and the price retreated back below 1.2545. In its Financial Stability Report (FSR), the Bank of England warns of the risks of a no-deal Brexit and global financial vulnerabilities. Here are the highlights: Perceived likelihood of no-deal Brexit has risen. Market volatility will increase after a disorderly Brexit. No-deal Brexit could cause material economic disruption. UK banks have enough capital to handle a disorderly Brexit.

The pair currently trades 0.25 percent higher at 1.2533. On technical side the bearish momentum persists as the pair still trading below all the major hourly and daily moving averages. Support for the pair stands 1.2502 the hour moving average and then at today’s low at 1.2497. On the upside immediate resistance stands at 1.2571 the daily high and if the pair manages to close above it might continue with an attempt to 1.2711 the 50 day moving average.Don’t miss a beat! Follow us on Twitter.

Download our Q3 market outlook today for our longer-term outlook for the markets and trade ideas.