- Summary:

- Gold gets a boost from USD weakness after Fed Chair Jerome Powell highlighted the downside risk to inflation while we are heading for a 25 basis point cut

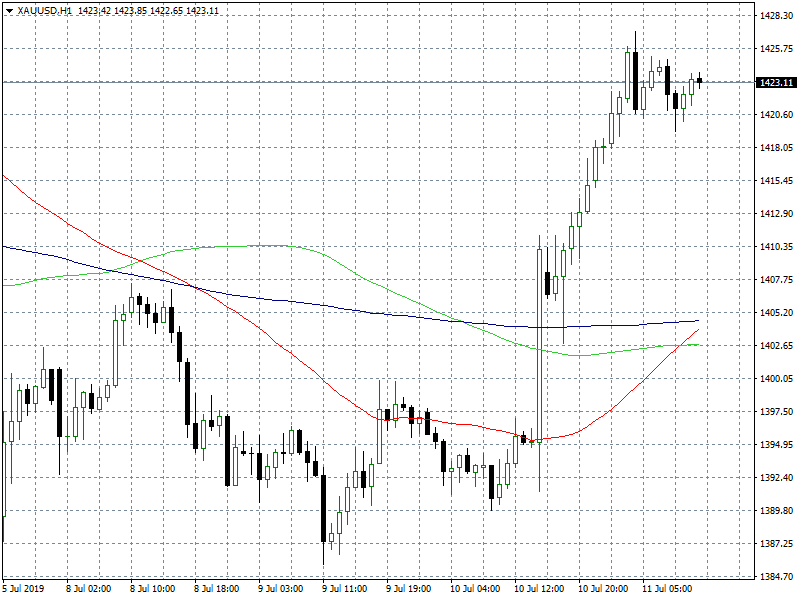

Gold gets a boost from USD weakness after Fed Chair Jerome Powell highlighted the downside risk to inflation while we are heading for a 25 basis point rate cut. The Minutes statement of the June monetary policy meeting by the FOMC revealed that there are a few members who are highly in favor of more rate cuts. Gold breached the 1,400 level after the news and register an impressive rebound aboe1,420.

Gold consolidates to yesterday high around 1,420. The low for the day was at 1,417.97 and the high at 1,427.09. The main trend is still bullish and now the short term momentum has also shifted to the upside. Immediate support for the yellow metal stands at $1,404 the 200 hours moving average, then at 1,389 the low from yesterday, while more solid support can be found at 1,357 low from June 20th. On the upside resistance would be met at 1,427 the today’s high and 1,439 the high from June 26th. Traders must be cautious on gold at current level as the volatility is very high. Bulls are controlling the game as long as the price holds above 1,410.Don’t miss a beat! Follow us on Twitter.

Download our Q3 market outlook today for our longer-term outlook for the markets and trade ideas.