- Summary:

- GBPUSD is trading 0.10 percent lower at 1.2580 after the US initial jobless claims for the week of June 29th came in at 221,000 versus forecasts of 223,000

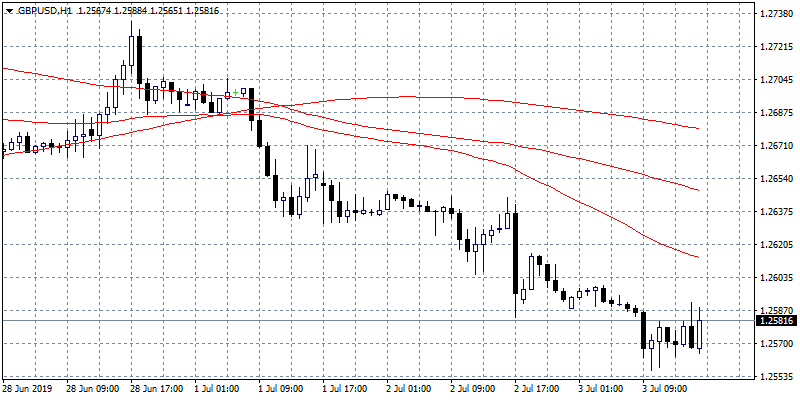

GBPUSD is trading 0.10 percent lower at 1.2580 after the US initial jobless claims for the week of June 29th came in at 221,000 versus forecasts of 223,000 the prior week revised higher to 229,000 versus 227,000. The 4 week average came at 222.25K versus 221.75K. The Continuing Jobless Claims came in at 1.686M, beating analysts’ forecasts of 1.675M for June 21. The U.S. Trade Balance recorded at $-55.5B worst than analysts’ expectations from $-54B in May. The US exports increased by 2.0% while the Imports increased by 3.3%. The US China May deficit was at $30.2B vs $26.9B before.

On technical side the bearish momentum persists as the pair trading below all the major hourly and daily moving averages. Support for the pair stands at todays low at 1.2556 and then at 1.2542 the low from June 19th. On the upside immediate resistance stands at 1.2613 the 50 hour moving average and if the pair manages to close above it might continue with an attempt to 1.2679 the 200 hour moving average.Don’t miss a beat! Follow us on Twitter.