- Summary:

- USDCAD plunges in Thursday's trading session as the greenback comes under pressure from expectations of expanded stimulus and poor data.

The USD/CAD has slumped to fresh weekly lows near 1.2650 after the greenback came under renewed selling pressure in the New York session.

Despite a slight drop in crude oil prices on the WTI benchmark, the US Dollar Index also retreated from intraday highs, after macroeconomic data showed a surge in the initial jobless claims for the week ended January 9.

Also putting pressure on the greenback is the expected rollout of a vastly expanded fiscal stimulus plan by incoming US President Joe Biden, who is expected to provide details in a Friday morning speech.

Furthermore, FOMC Chairman Jerome Powell will provide insight into the Fed’s view of the US economy at a policy outlook online event.

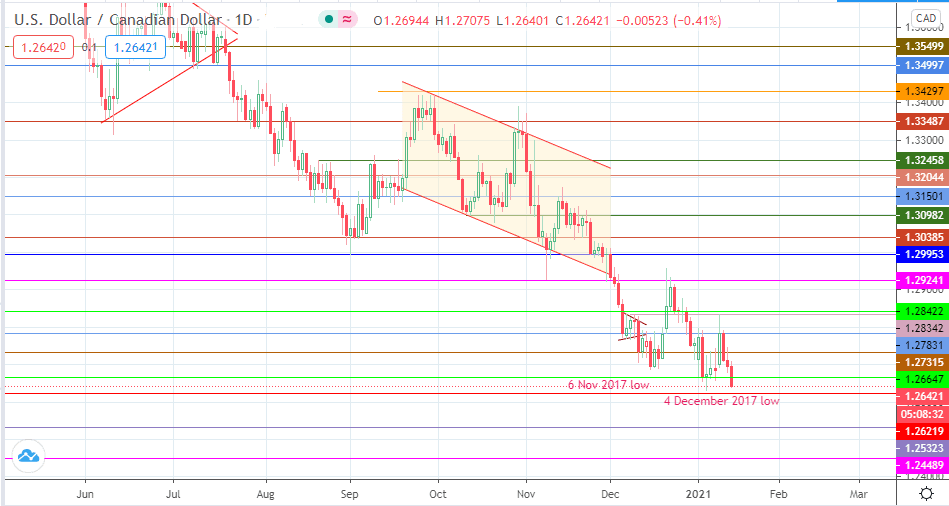

Technical Levels to Watch

Thursday’s decline lines up the USDCAD to retest recent lows at 1.26478. The 19 February and 16 April lows at 1.25323 await sellers as a potential downside target if the 1.26478 support is taken out by sellers. Below this area, 1.24489 (16 October 2017/12 February 2018 lows) lines up as an additional downside target.

However, if 1.26464 is able to stave off selling pressure on the pair, then a bounce could allow buyers to target 1.26647 initially, followed by 1.27315 and 1.27831 if the buying pressure is maintained. Only a push above 1.29241 gives the USDCAD a fair chance at reversing the strong downtrending price action.

USDCAD Daily Chart