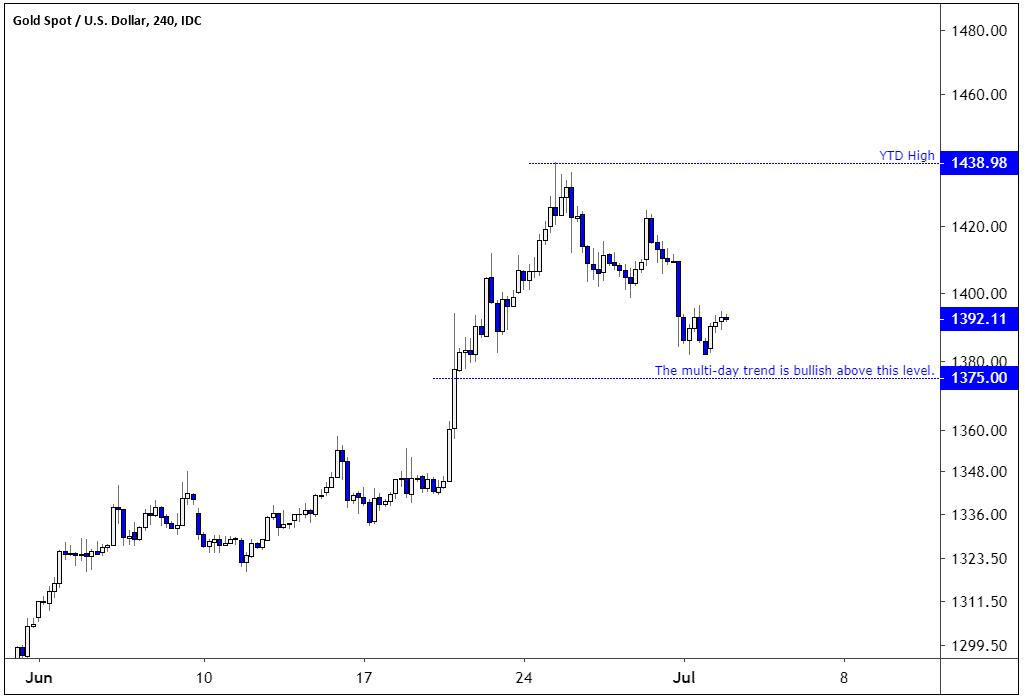

Gold prices have stabilized following a tumult start to the week. The price found support just above the critical $1375 level, at $1381. We highlighted the $1375 in last week’s Gold update when gold prices were trading at $1425. The idea then was that the price would trade between the year-to-date high at $1438.98 and the $1375 level, before heading higher. I also suspected that price would find support at $1404, which it did at first but following the G20 meeting, the truce between the US and China, and the Trump-Kim meeting gold prices slid. However, as the price remains above the important 1375 level, the outlook for gold prices remains intact for now.

I suspect that gold prices will continue to struggle in the next few days, but a break to $1396 could confirm that prices have found a short-term low. A possible market volatility trigger is tomorrow’s ADP report. The last reading showed the US economy only created 27 thousand new jobs, and a repeat of the same dismal figure could send gold prices higher as the theme of a slower U.S. economy would extend. Economists project that 140,000 jobs were created in June.

However, if the ADP report beats expectations and shows job creation landed about 180,000 then I suspect gold prices might come under pressure.

A drop below the $1375 level might send prices towards $1350, and the bullish breakout above the2014, 2016, 2018 highs would come under question.Don’t miss a beat! Follow us on Twitter.