- Summary:

- Crude oil bulls remain in control, as there are no signs of the US-Iran tensions deescalating. What levels could traders be targeting?

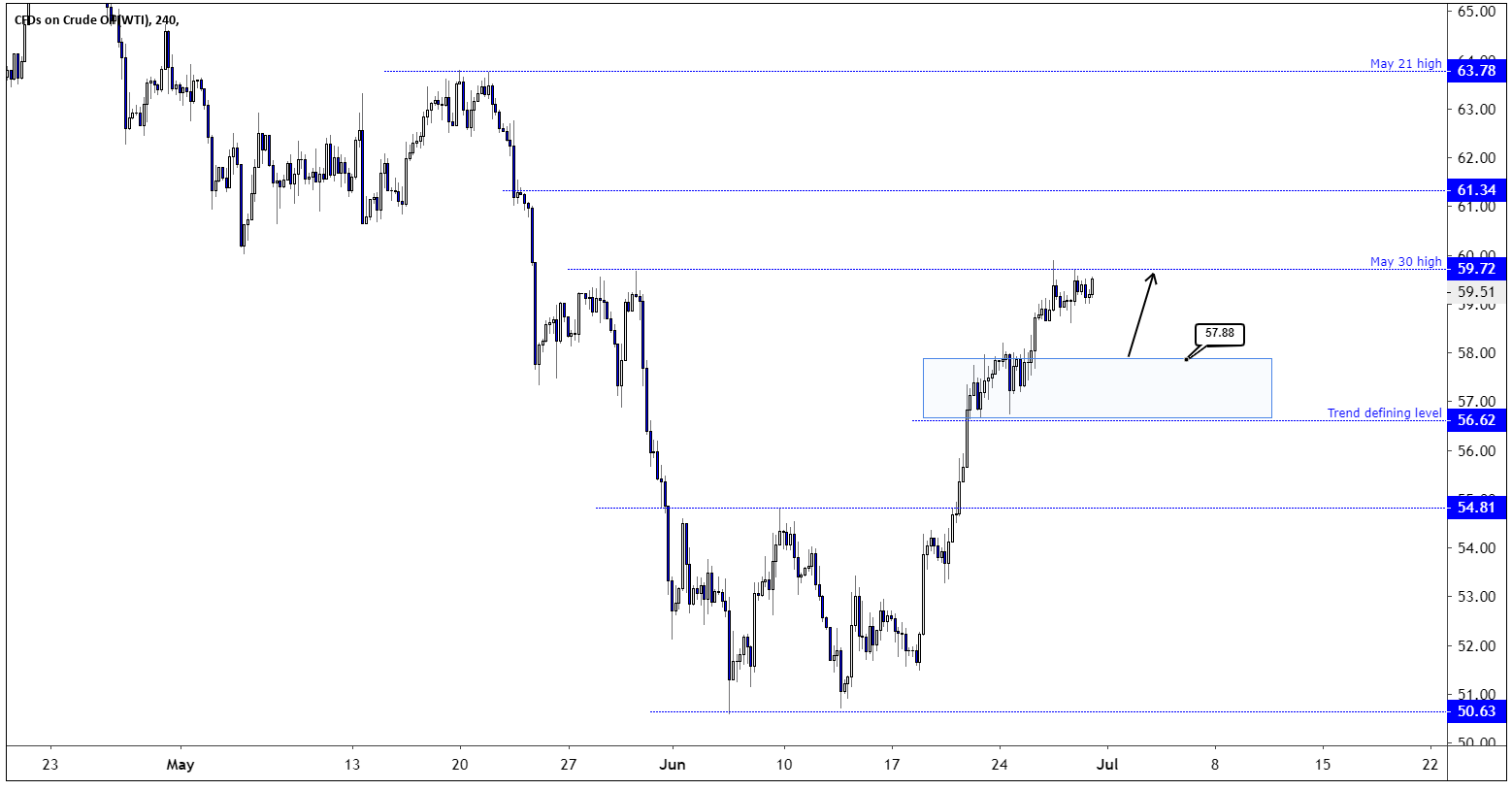

Crude oil bulls remain in control, as there are no signs of the US-Iran tensions deescalating. In the very short-term, the oil price trend remains bullish above the June 21 low of $56.62, and as long as the price trades above this level there is a risk that WTI crude oil prices continue to drift higher. The next resistance level is the May 30 high of $59.72, and a break to the high could send prices towards the next resistance level located at the $61.34 level. However, I don’t think it will be an easy ascent as crude oil prices are short-term overbought since turning aggressively bullish on June 18 from the $51.48 level, and I suspect bullish breakouts could be hard to trade. Instead, I suspect traders will wait for a pullback to the $57.88 level to obtain a better risk-reward ratio for long positions. A break to the $56.62 level might send prices towards the June 9 high at $54.72.Don’t miss a beat! Follow us on Twitter.