- Summary:

- The NZDUSD has been surging in the last few days, but it has nothing to do with people buying the NZD, instead, it had to do with people selling the USD.

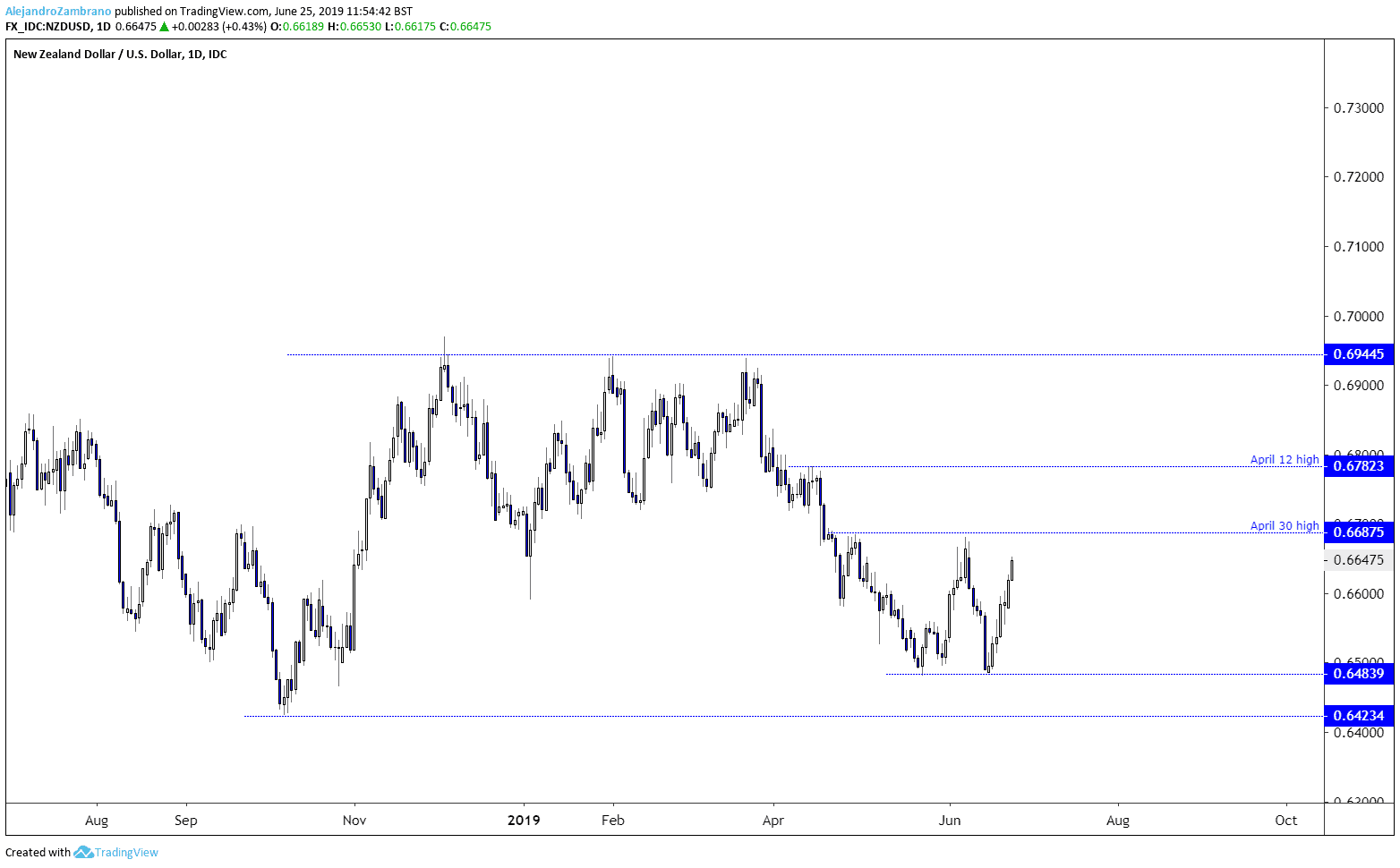

The New Zealand dollar (NZDUSD) has been surging in the last few days, but it has nothing to do with people buying the NZD, instead, it had to do with people selling the USD. Technically, the price is now approaching the April 30 high at 0.6687, which also happens to be a level just above the June high at 0.6681. Unless US data improves fast and dampens the expectations of Fed rate cuts, I anticipate that the market will try to trigger stop-loss orders just above the June high.

On a credible break to the June high, the next resistance level, and likewise potential profit target of bullish traders will be the April 12 high at 0.6782. Yet, I don’t expect this to be an easy trade as the NZDUSD pair has is since August 2018 trading sideways between the 2018 low at 0.6423, and the 2019 high of 0.6944. When the price is trading sideways like the NZDUSD, then any minor level such as the April 30 high is less respected, and a break to the level might not do much more than just triggering a few stops before the price once again starts to oscillate.

On Wednesday, the New Zealand Central bank, the RBNZ, is set to share their latest outlook for monetary policy. Economists are not expecting any changes following their 25-bps rate cut to 1.5% in May. Instead they are projecting a rate cut at the August rate meeting.

In May, the central bank cut rates to help sooth the economy before the economic downtrend would pick up in pace. However, the RBNZ’s projections in May suggested that rate cuts of 40 bps were needed to balance the economy, thus the market is projecting another rate cut in 2019.

As the Fed and RBNZ are both expected to reduce rates, NZDUSD will likely remain choppy, but maintain a bit of a bullish drift as investors are more bearish on the Fed than the RBNZ.