- Summary:

- FTSE 100 started the week flat at 7,343 as traders adopted a cautious stance on risk heading into this week's key event; the FED policy meeting while global

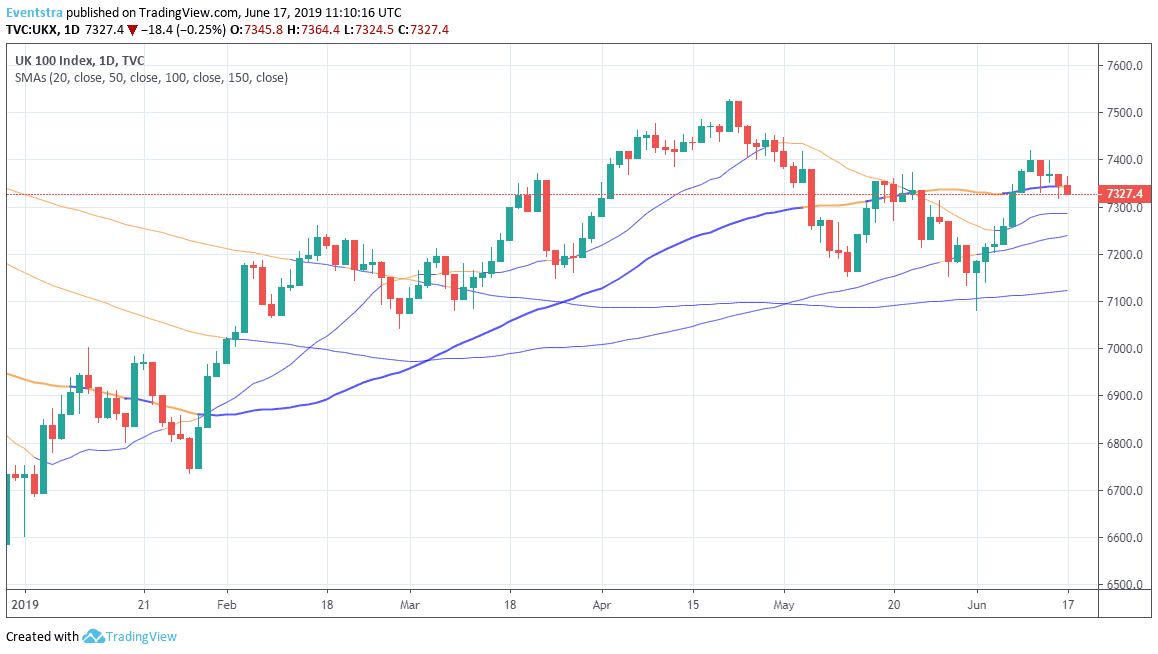

FTSE 100 started the week flat at 7,343 as traders adopted a cautious stance on risk heading into this week’s key event; the FED policy meeting while global markets closely monitoring military developments in the Gulf region and an escalation in US-China trade war. The July futures suggest a 66.6% chance of a cut as inflation slows and the global economy weakens. Interest rate policy announcements are also due from the Bank of England and the Bank of Japan, both of which are expected to keep rates unchanged. Bank of England should continue giving support to the London financial markets in an effort to improve the mood among investors, as the Brexit uncertainty continue to weigh on markets. The cheap Cable which trades at yearly low attracts investors to UK stocks.

The technical picture for the index is bullish as it trades above the key 100 key moving average. Immediate resistance for FTSE100 stands at 7,525 the high from 24 April. On the downside first support stands at 7,286 the 20 day moving average while more bids will emerge at 7,237 the 100 day moving average.