- Summary:

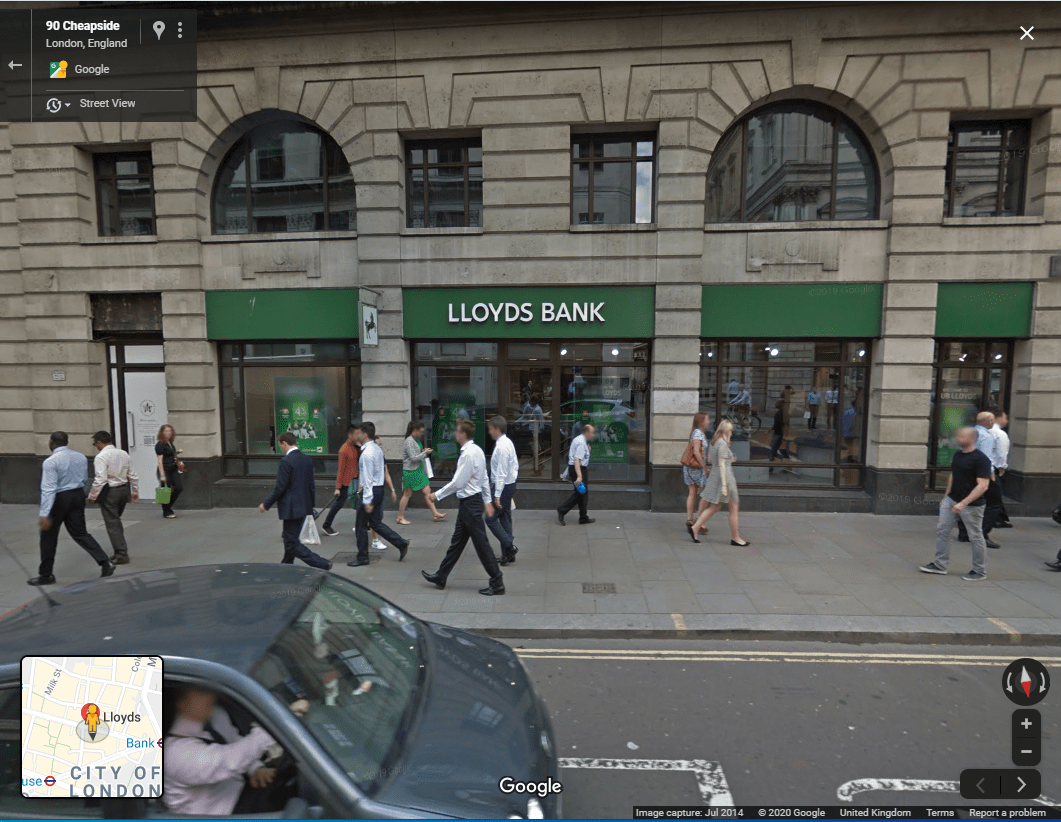

- Lloyds Share price has been in trouble in recent years. The challenges continued after the latest earnings report. Is it time to invest in the bank?

Lloyds share price is deeply in the red today as investors continue to worry about the health of the world economy. The shares are down by more than 1.4% while the overall FTSE 100 is down by 0.83%. Other banks are also in the red, with Barclays shares falling by more than 2.69% and Standard Chartered and NatWest falling by more than 2%.

Lloyds stock has been under intense pressure in recent months. The stock has dropped by more than 56% this year, becoming one of the worst stocks in the FTSE 100. It has also dropped by more than 60% in the past five years.

There are several reasons why Lloyds share price has been under pressure. First, as the biggest bank in the UK, the company has been affected by the growing uncertainties about Brexit. These concerns have generally led to more caution among UK residents and companies.

Second, this year, Lloyds Bank has suffered because of its exposure to interest income. Its interest income has fallen significantly because of low interest rates. Third, it has also been exposed to credit defaults. In the most recent quarterly earnings, the bank said it allocated more than £2.4 billion in provisions.

Finally, from a returns perspective, Lloyds bank has been affected by its lack of a trading division. This is in contract to Barclays, one of its closest competitors in the UK. Barclays’ international division, which houses its investment bank has helped cushion the bank against risks.

Analysts have also had mixed opinion about Lloyd’s stock target. In a recent note, analysts at Deutsche Bank reiterated their neutral call on Lloyds. They left their target for the stock at about 32p, which is a fe points above the current level. They noted:

“We remain cautious on UK banks and prefer banks with less rate sensitivity, more diverse income, flexible cost bases and at lower valuations.”

At the same time, analysts at Jefferies, Shore Capital, UBS, and Barclays have remained optimistic about Lloyds stock price.

Lloyds share price forecast

The daily chart below shows that Lloyds share price has been under pressure. It dropped to a multi-year low of 25.15p after it reported weak earnings a few weeks ago. Before that, its lowest level this year was 27.20p that it reached in April. The stock has simply struggled to move above 38p, a level which it reached in June.

It is still below the 50-day and 100-day exponential moving averages while its volatility has dropped to the lowest level this year. At this point, I expect that Lloyds stock will continue being under pressure in the near term because any attempts to recover have found strong resistance. As such, so long as it is below the two moving averages, I expect it to continue falling.

Lloyds share price chart